News

[Market Report] Inflation Impact on Household Finance

- 24/05/2024

- News

Inflation, the rising cost of goods and services, is a pressing concern for individuals and policymakers alike. While its effects are felt across the economy, households are particularly vulnerable as inflation erodes purchasing power and disrupts financial planning. This report delves into the multifaceted impact of inflation on household finance.

We will explore how inflation squeezes household budgets, and forcing adjustments in spending habits. The report will examine how different income groups are disproportionately affected, with low-income households often bearing the brunt of rising essential good prices.

Furthermore, the report will explore the potential measures and preferred investment options that mitigate the negative impacts of inflation. By understanding the intricacies of inflation's influence on household finance, we can be better equipped to manage its challenges and promote financial resilience.

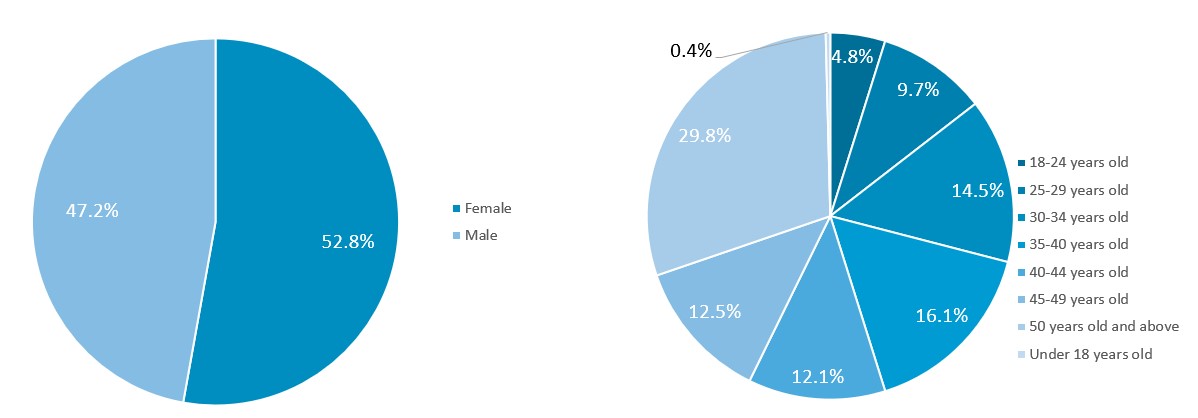

Respondents' Demographic

The survey sample shows a near-equal gender distribution with a slight female majority (52.8%). The largest age group is those 50 years old and above (29.8%), reflecting an older demographic for this sample.

The diverse age distribution also highlights the participation of both younger and older adults in financial planning and awareness activities.

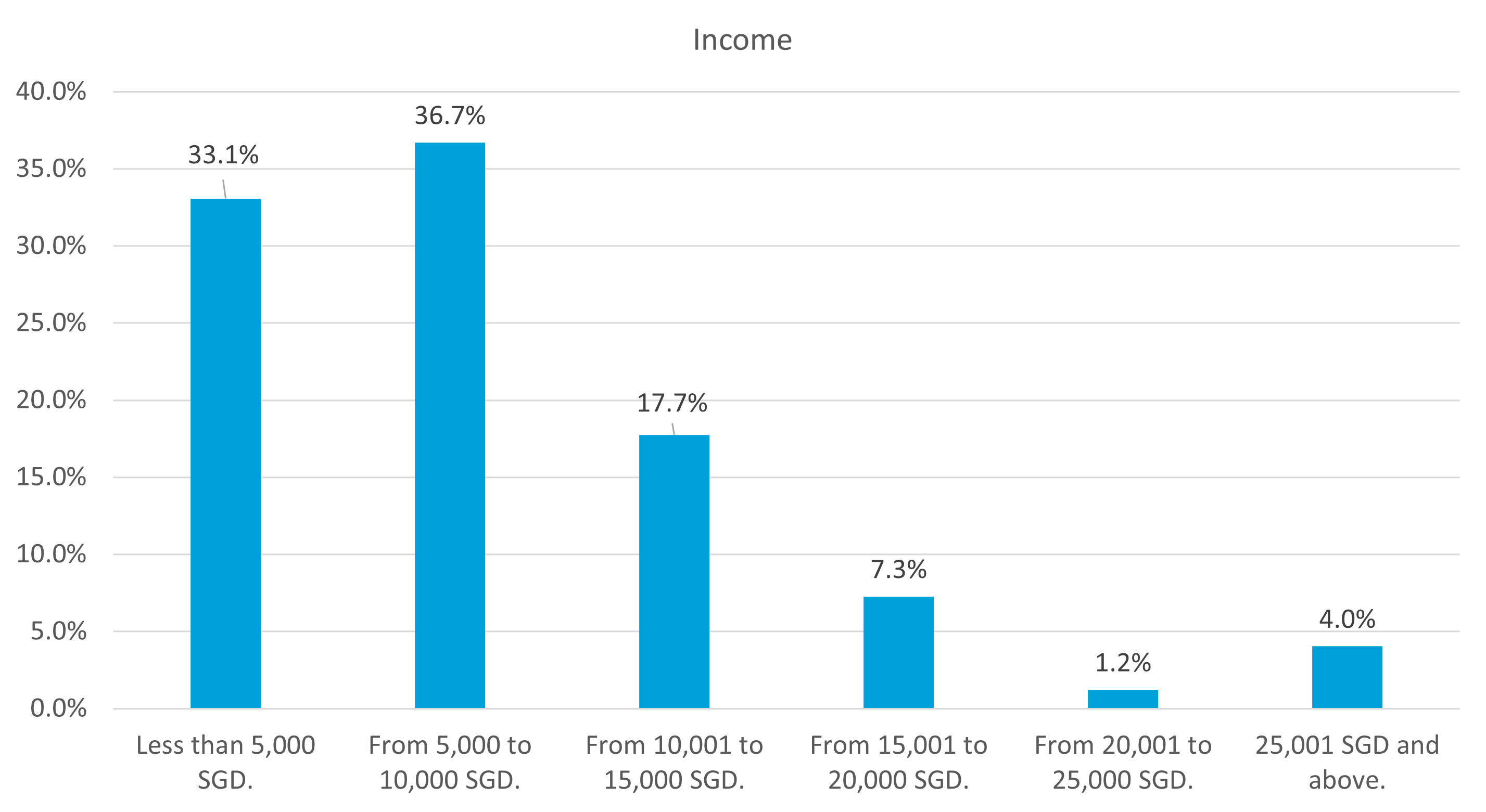

Monthly household income

A significant proportion of respondents (36.7%) have a household income between 5,000 and 10,000 SGD.

The income distribution indicates a substantial middle-income group, reflecting Singapore's high standard of living and economic prosperity.

However, the notable percentage of households earning less than 5,000 SGD (33.1%) highlights the income disparity and cost-of-living challenges in the city-state.

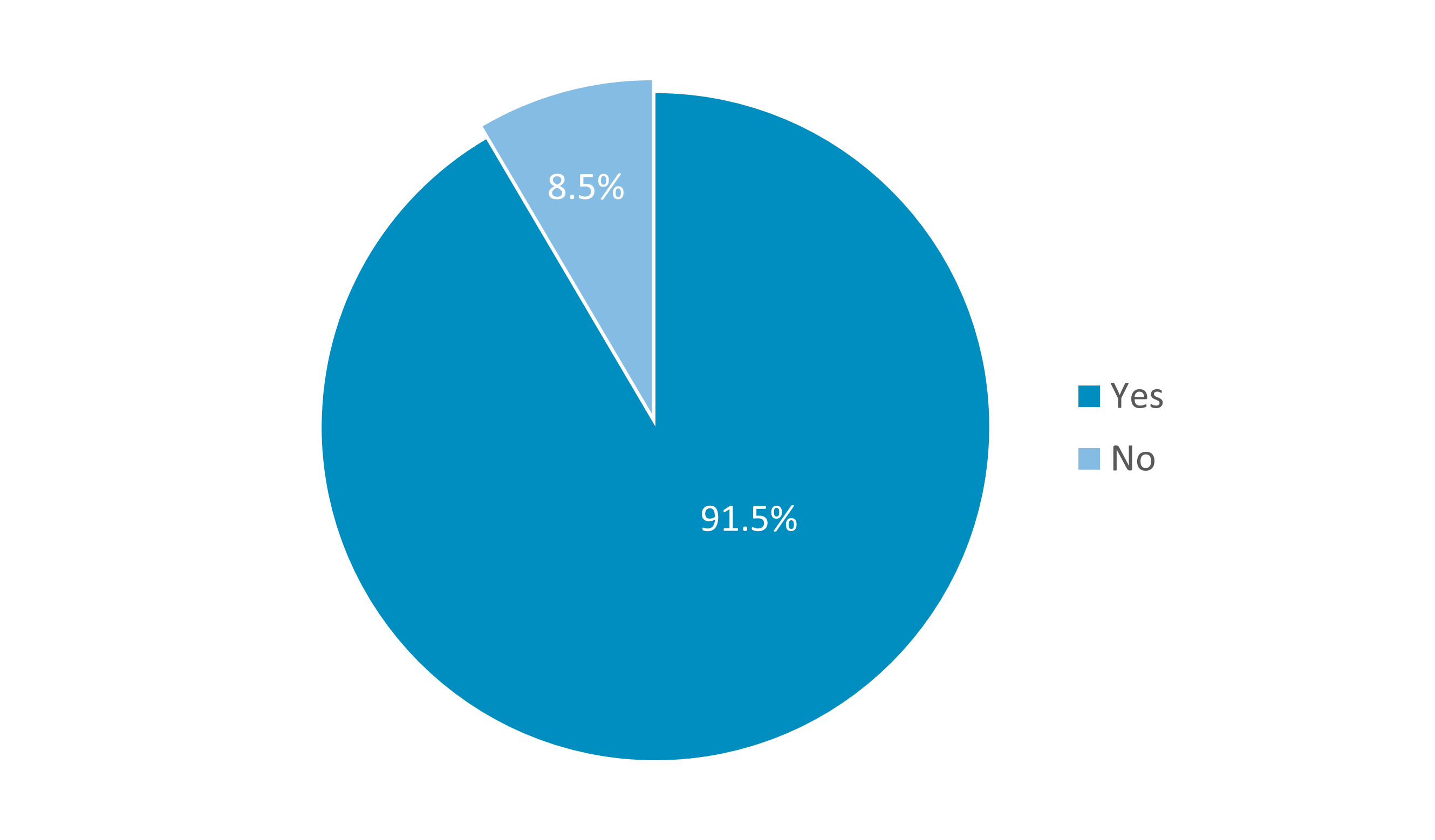

Awareness of Global inflation

An overwhelming majority (91.5%) are aware of the impact of global inflation on household finances, showcasing high financial literacy.

This high level of awareness is consistent with Singapore’s focus on education and financial planning, which is crucial in a small, open economy vulnerable to global economic fluctuations.

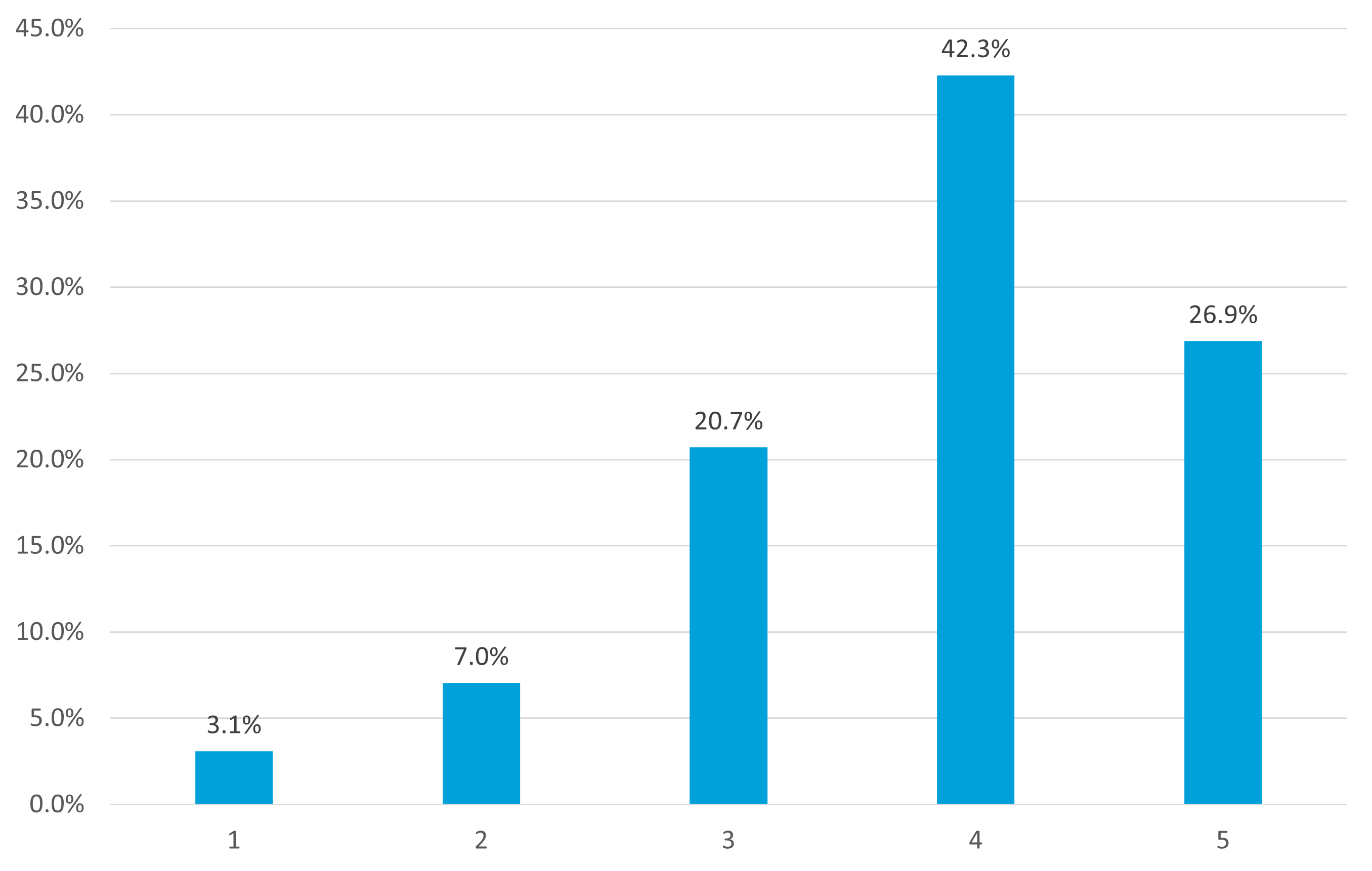

Impact of Global Inflation on Household Finances

On a scale of 1 to 5, with 1 being "Not at all affected" and 5 being "Severely affected".

A significant number of respondents feel a strong impact from global inflation, with 42.3% rating it as a 4 and 26.9% as a 5 on the severity scale.

This suggests that inflation is a considerable concern for many households, likely due to the high cost of living and reliance on imported goods in Singapore.

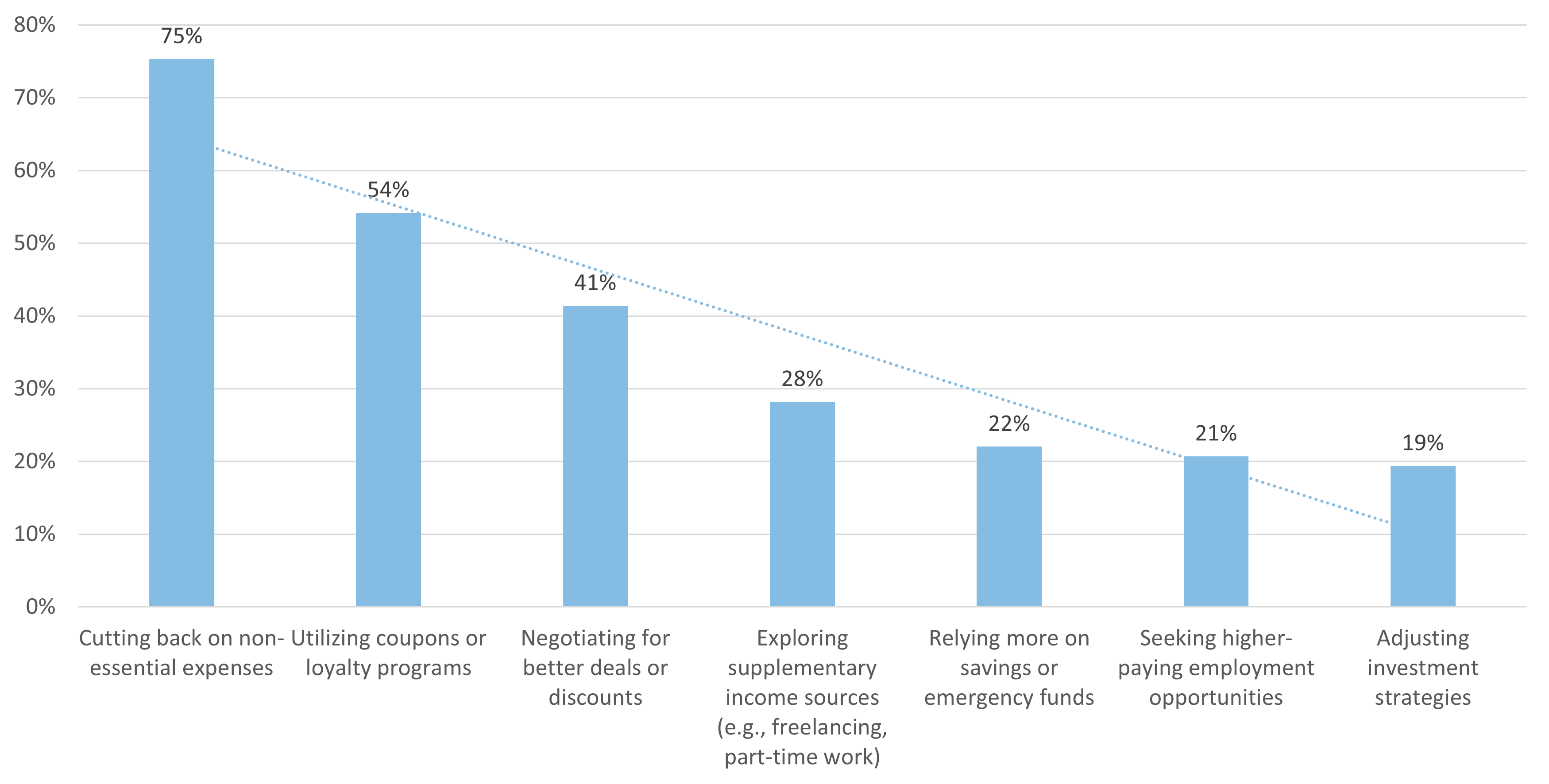

Measures Taken to Mitigate the Impact of Inflation

The most common measure is cutting back on non-essential expenses (75%), followed by utilizing coupons or loyalty programs (54%).

This reflects a pragmatic approach to managing finances amidst inflation, leveraging Singapore’s developed retail ecosystem that offers discounts and loyalty rewards.

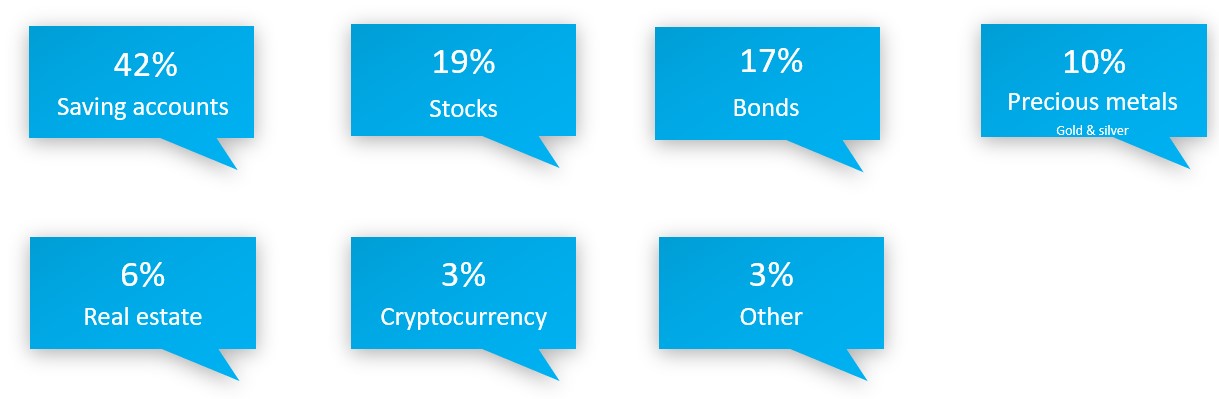

Preferred Investment Options Amidst Inflation

Savings accounts (42%) are the most preferred investment option, indicating a conservative approach. The inclination towards bonds (17%) and stocks (19%) also reflects a balanced investment strategy aimed at securing stable returns amidst economic uncertainty.

This aligns with the financial prudence typically observed in Singaporean culture.

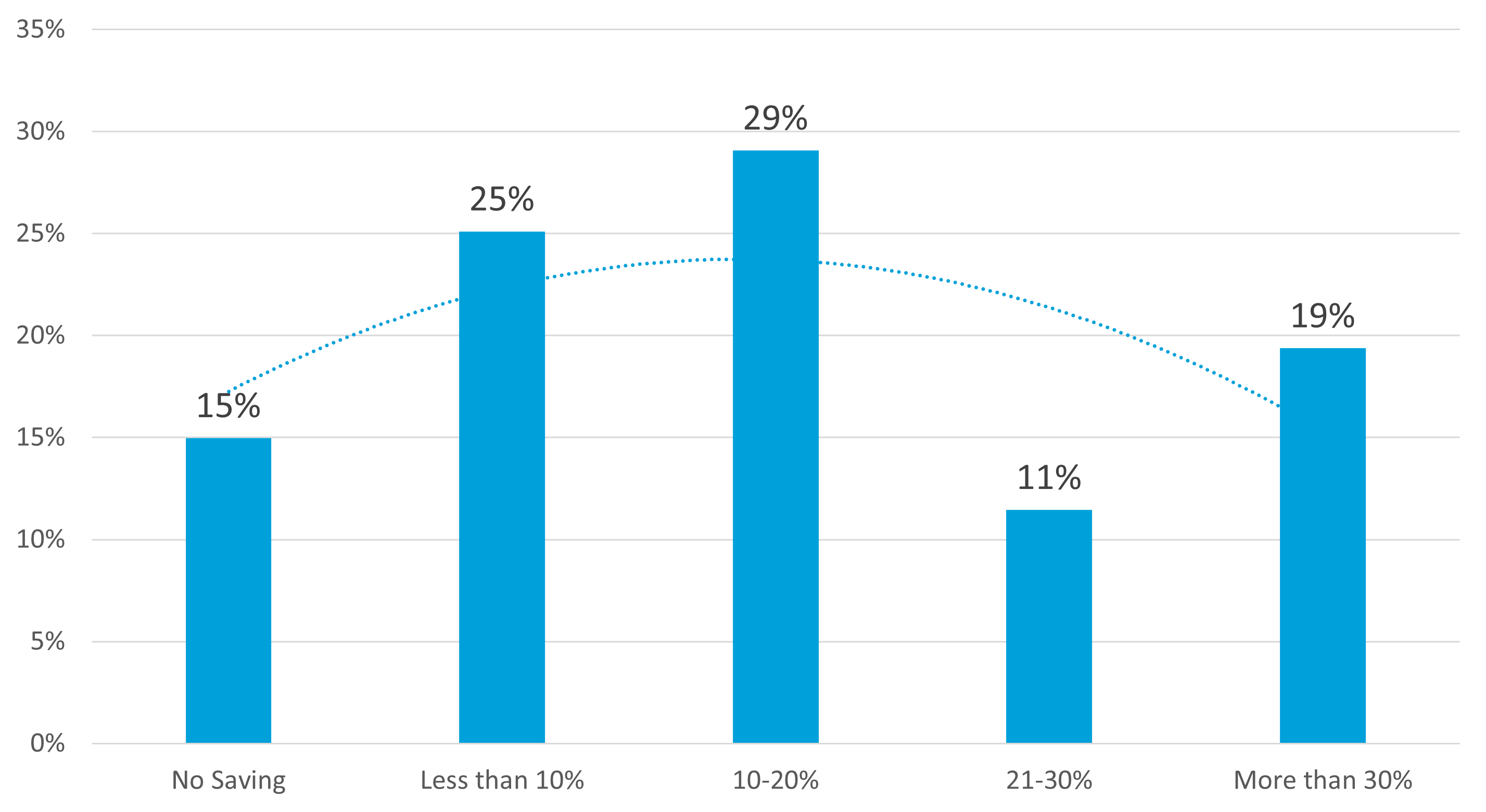

Monthly Income Savings Percentage

A significant portion of respondents save 10-20% of their income (29%), showing a moderate saving habit.

The relatively high percentage of respondents saving more than 30% (19%) underscores the importance placed on savings in Singapore, where financial security and preparedness for future uncertainties are highly valued.

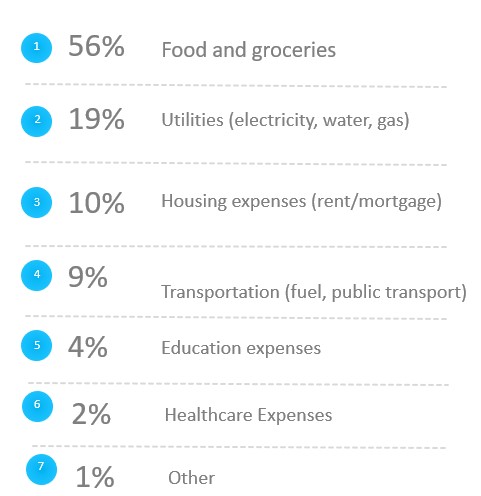

Anticipated Areas Most Affected by Inflation

Food and groceries (56%) are anticipated to be the most affected area by inflation, followed by utilities (19%). This is particularly relevant in Singapore, where food security is a concern due to reliance on imports.

Rising food prices can significantly impact household budgets, making it a critical area of concern.

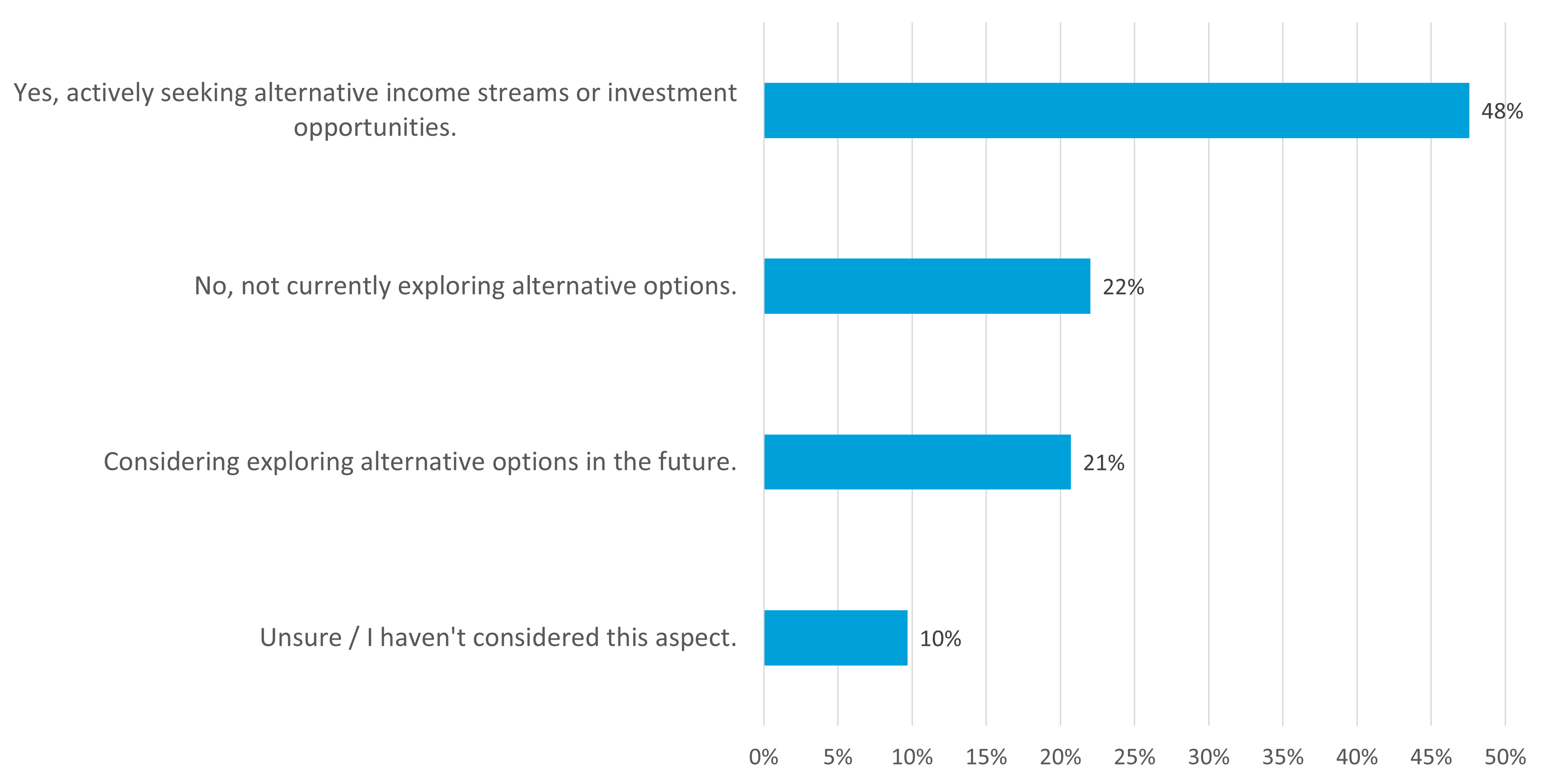

Exploration of Alternative Income Streams or Investment Opportunities

Nearly half of the respondents (48%) are actively seeking alternative income streams or investment opportunities, indicating proactive financial behavior.

This trend is indicative of the high level of financial awareness and the dynamic nature of Singapore’s economy, where individuals often explore multiple avenues to enhance their financial resilience.

Impact of Inflation on Financial Goals

30% believe inflation will significantly hinder their ability to achieve financial goals, highlighting widespread concern.

This reflects the challenge that inflation poses to long-term financial planning in Singapore, where maintaining purchasing power is essential in a high-cost environment.

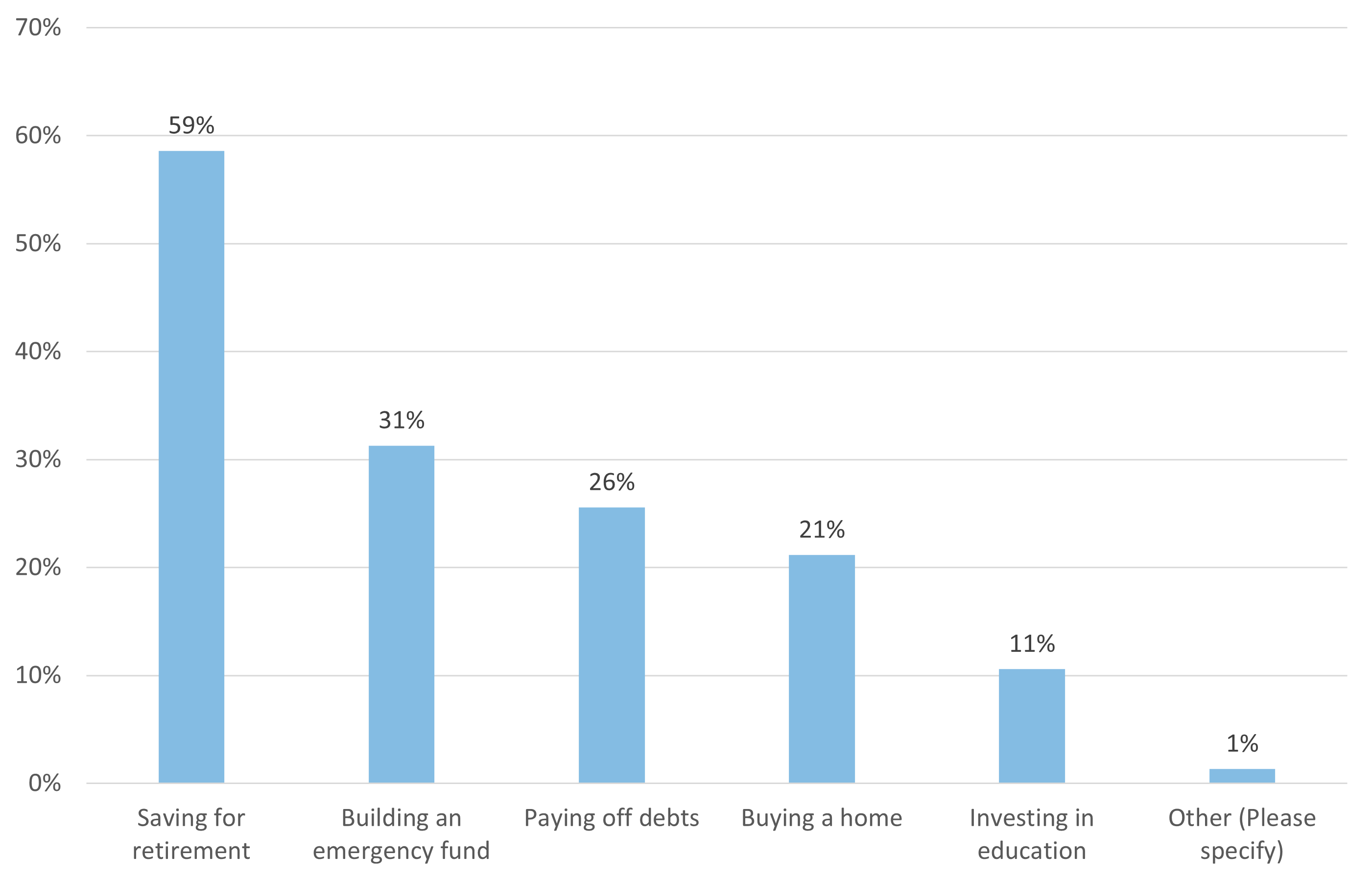

Primary Financial Goals for the Next 5 Years

Saving for retirement (59%) is the top financial goal, indicating a long-term focus among respondents on financial planning.

This goal is particularly significant in Singapore, where the cost of living and healthcare is high, necessitating substantial personal savings for retirement.

Building an emergency fund is the top 2 goal (31%), reflecting Singaporean are alert in uncertainty and well prepared for contingency plan.

Conclusion

The survey reveals a high level of awareness regarding global inflation among Singaporean households, with significant concerns about its impact on finances.

Most respondents are taking measures to mitigate this impact, primarily by cutting non-essential expenses and utilizing loyalty programs. Savings accounts are the preferred investment during inflationary periods, reflecting a cautious approach consistent with Singaporean cultural values of prudence and financial security. There is a proactive stance towards exploring alternative income sources.

However, there is widespread concern that inflation will hinder achieving financial goals, with a strong focus on saving for retirement and building an emergency fund. This aligns with the traditional emphasis on financial prudence and long-term security, underscoring the cultural and economic resilience of Singaporean households.

![[Market Report] Inflation Impact on Household Finance|News|News|Z.com Research Singapore Home Page](/theme/ZRSG/img/siteLogo.svg)