Market Report: COVID-19 Spikes Again – Public Response in India and Singapore

As the world braces for yet another surge of COVID-19 variants such as LF.7 and NB.1.8, fresh data from Z.com Research - a leading online panel platform - offers rich behavioral insights into public sentiment and response across two key Asian markets: India and Singapore.

This exclusive market report, based on a survey of 1,200 Indian and 350 Singaporean respondents, provides comparative data across demographics, attitudes, risk perception, testing behavior, and booster willingness. The findings reveal not only the level of awareness in each country but also deeper cultural and psychological responses that influence how people react to COVID-19’s re-emergence.

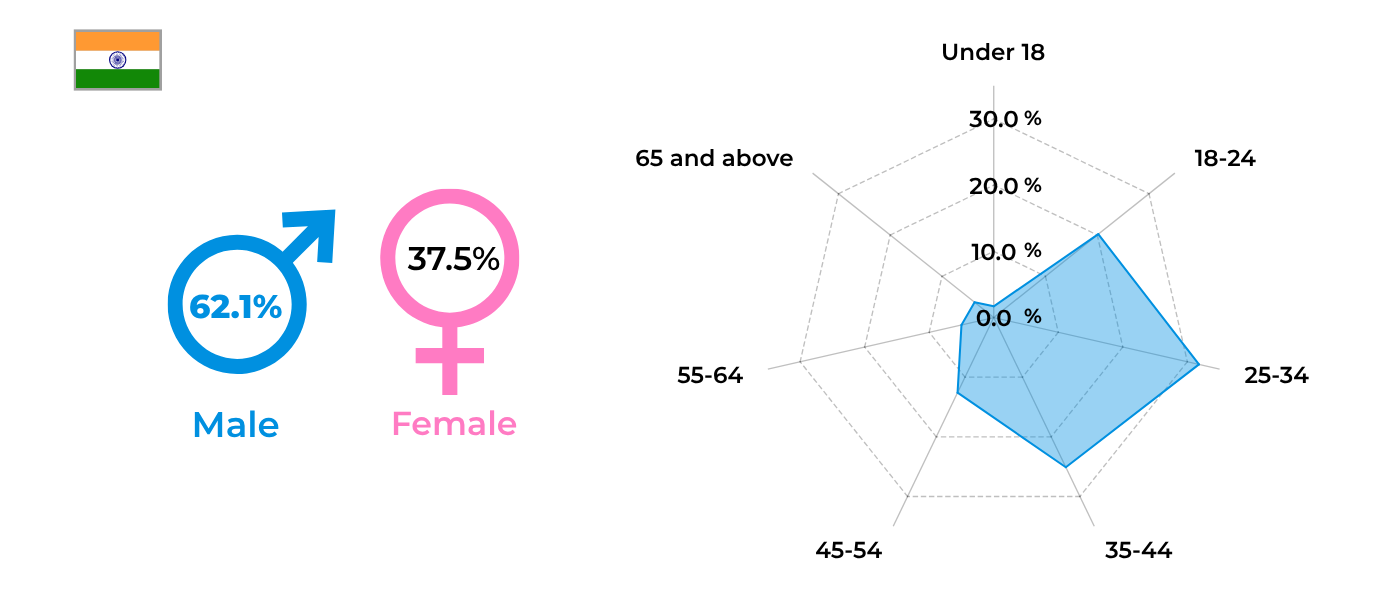

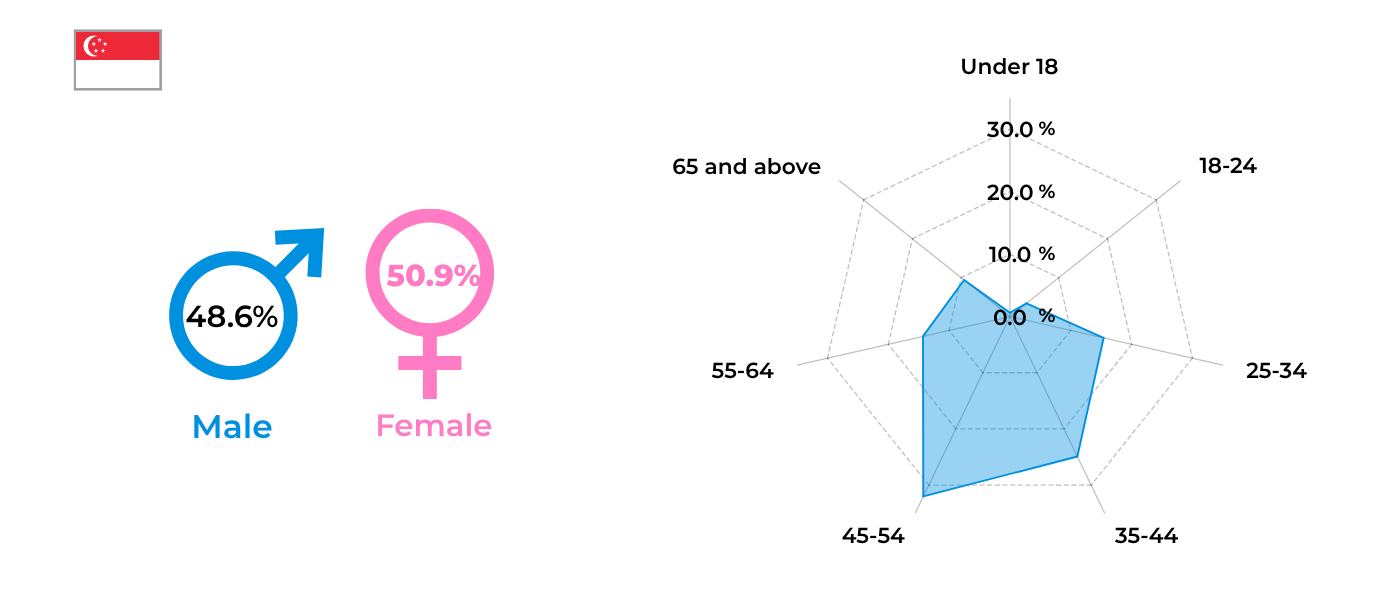

Demographic snapshot: Singapore’s older, more female-leaning base

India’s survey base skews younger, with over 50% between 18-34, compared to just 18.8% in Singapore. Meanwhile, Singapore’s sample includes significantly more respondents aged 45 and above (55.7%) compared to India’s 21.3%. Gender distribution also varies: while India’s response pool is 62.1% male, Singapore has a near-even gender split.

These demographics influence perceptions. Younger populations (like in India) may be more active online and more exposed to emerging COVID-19 concerns, whereas older groups (prevalent in Singapore) may lean toward caution - but also normalization due to previous experience and high vaccination rates.

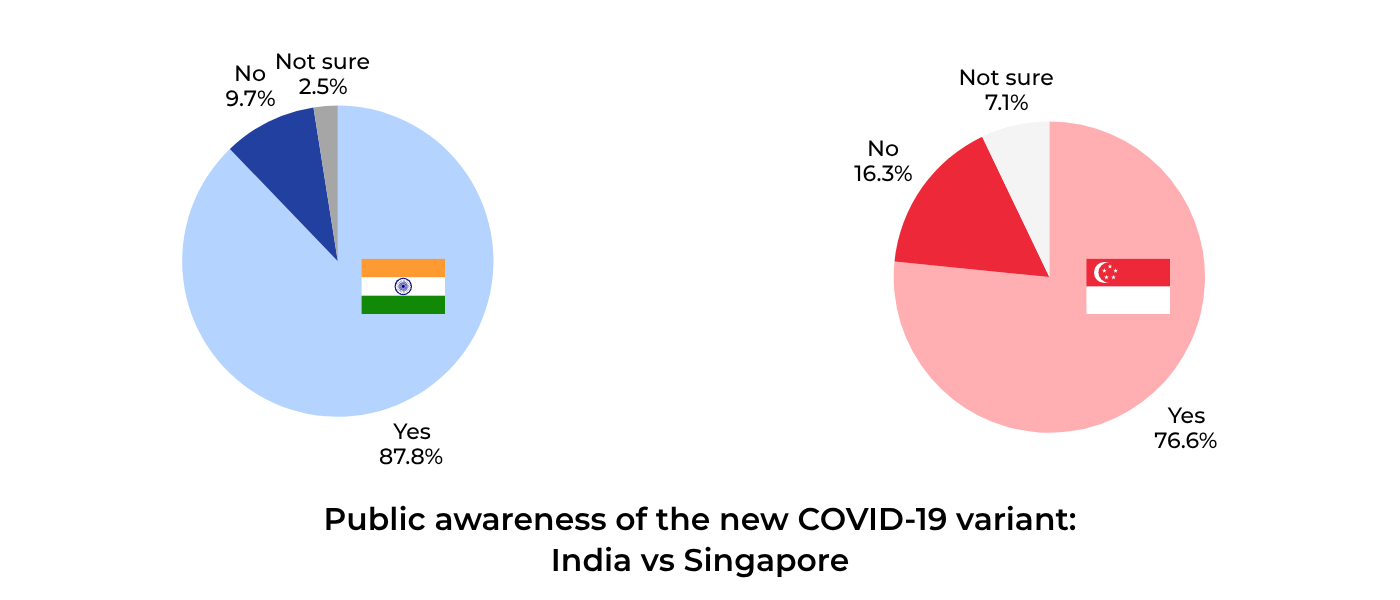

High awareness across both, but India stays more engaged

Both India and Singapore show high general awareness of the new Covid-19 variants, but India displays sharper attentiveness. A striking 87.8% of Indian respondents reported having heard of the new variant, compared to 76.6% in Singapore.

More tellingly, uncertainty is much lower in India, just 2.5% said "not sure", while 7.1% of Singaporeans were unsure if they had heard of the new variant.

This suggests stronger public discourse and media engagement in India, possibly amplified by recent cases and more aggressive variant reporting. In contrast, Singapore may be entering a "Covid fatigue" phase, where updates no longer command public attention with the same urgency.

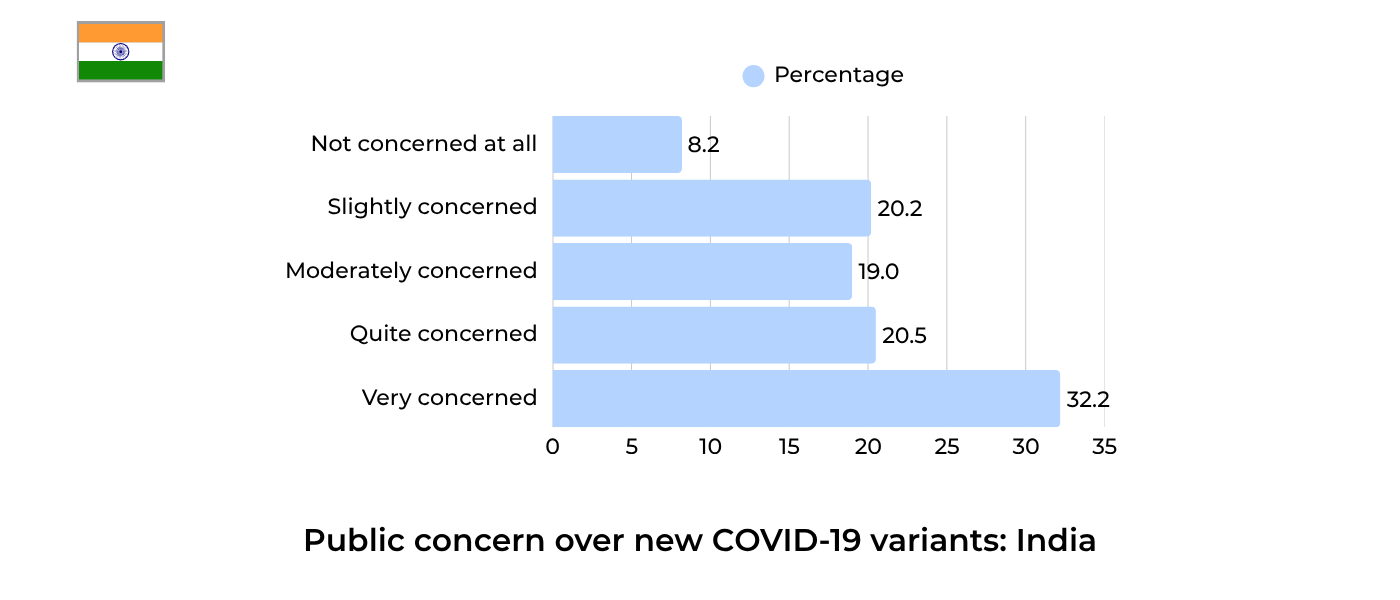

Why India is significantly more concerned about the new variant

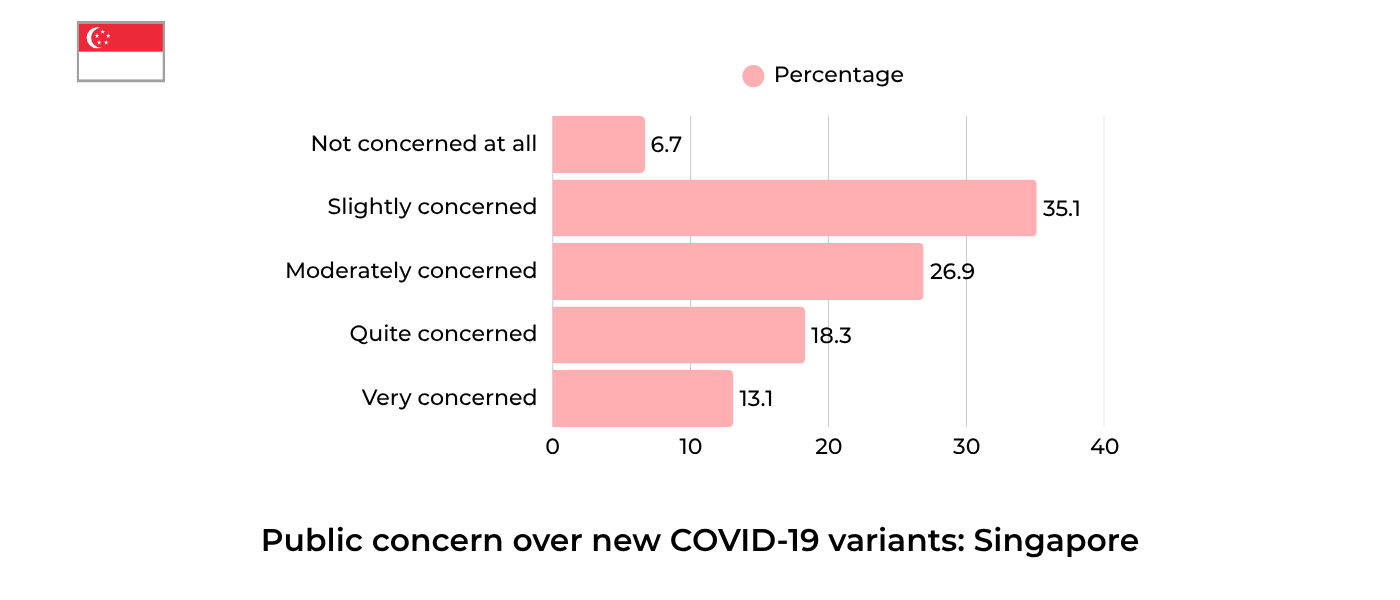

Public concern over the new variant reveals one of the clearest gaps between the two countries.

In India, 32.2% of respondents say they are "very concerned" about the new variant. In Singapore, that number drops drastically to 13.1%. When combining the “quite concerned” and “very concerned” groups, 52.7% of Indians express serious concern, compared to only 31.4% in Singapore.

What’s behind this emotional gap?

Several interrelated factors explain India’s higher sensitivity:

1. More recent Covid-19 activity in India

India has reported more local outbreaks and variant-related clusters in early 2025 than Singapore. According to the Indian Ministry of Health’s February and March 2025 updates, localized spikes in Delhi, Maharashtra, and Kerala have reignited public anxiety. This proximity to new infections makes the risk feel more real and immediate.

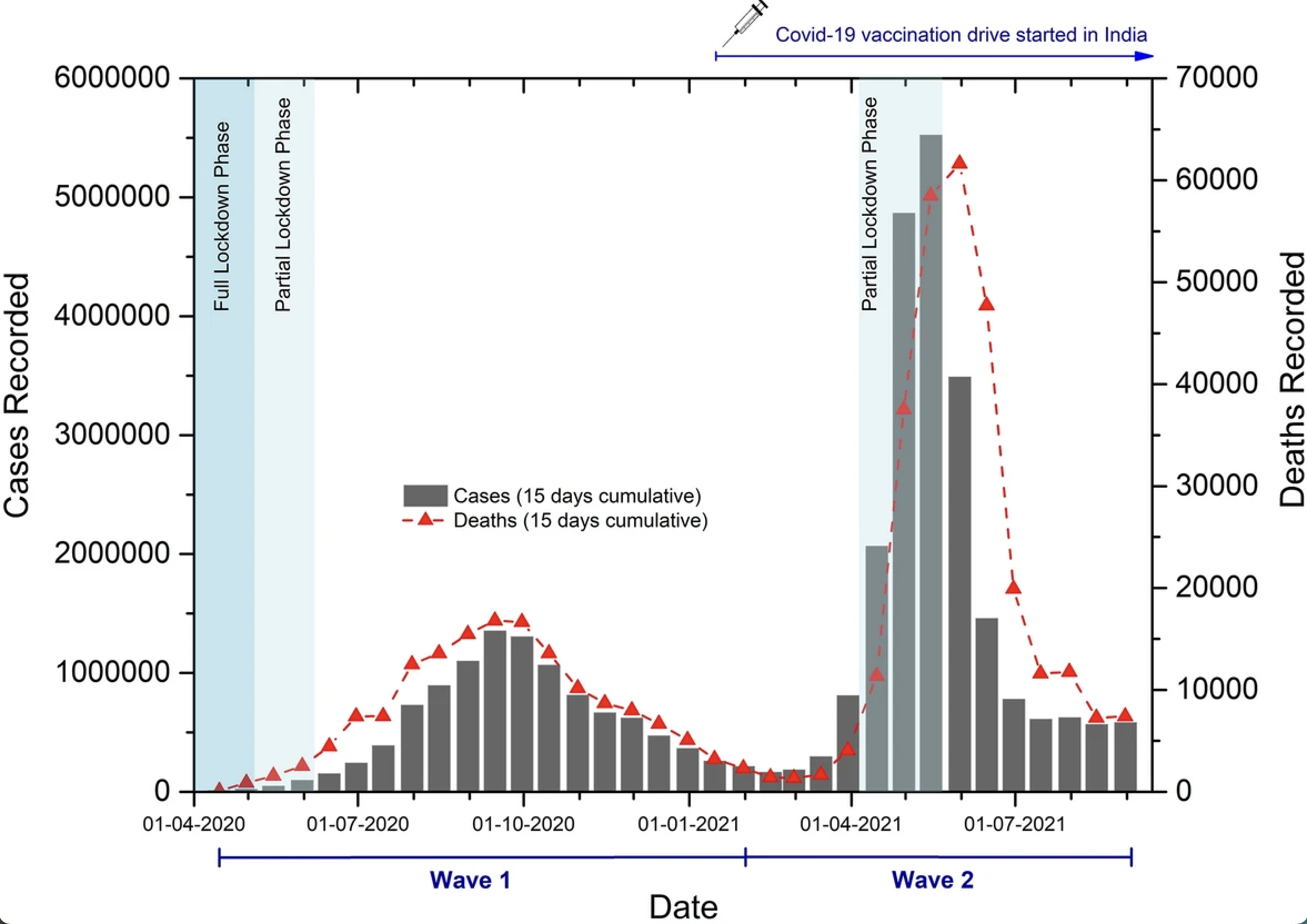

2. A traumatic pandemic history

India experienced one of the most devastating Covid-19 waves globally during the Delta surge in 2021, with over 4,000 deaths per day at its peak and chronic shortages in oxygen and ICU beds. The psychological scar of that period remains fresh. Entire families lost multiple members. Media images of funeral pyres and collapsing hospitals remain embedded in public memory.

Source: Scientific Reports

In contrast, Singapore maintained one of the lowest Covid-19 death rates globally, thanks to strict containment, a robust healthcare system, and strong trust in public authorities.

As a result, while Singaporeans acknowledge the virus, they do not fear it in the same way. Indians, however, associate new variants with a return to chaos, triggering faster concern escalation.

Singaporeans display a relaxed or pragmatic attitude

Singapore’s concern levels are distributed differently. The most common sentiment is “slightly concerned” (35.1%), significantly higher than India’s 20.2%. This suggests a population that is aware but unfazed, possibly trusting in government preparedness and personal health systems.

Interestingly, “moderately concerned” levels are comparable between the two countries: 26.9% in Singapore vs 19% in India. This midpoint reflects a shared layer of measured alertness, though India’s emotional reactions are skewed higher.

At the other extreme, low concern levels remain marginal in both countries: just 8.2% in India and 6.7% in Singapore report being “not concerned at all.” This shows Covid-19 remains on the radar in both populations, even if response styles differ dramatically.

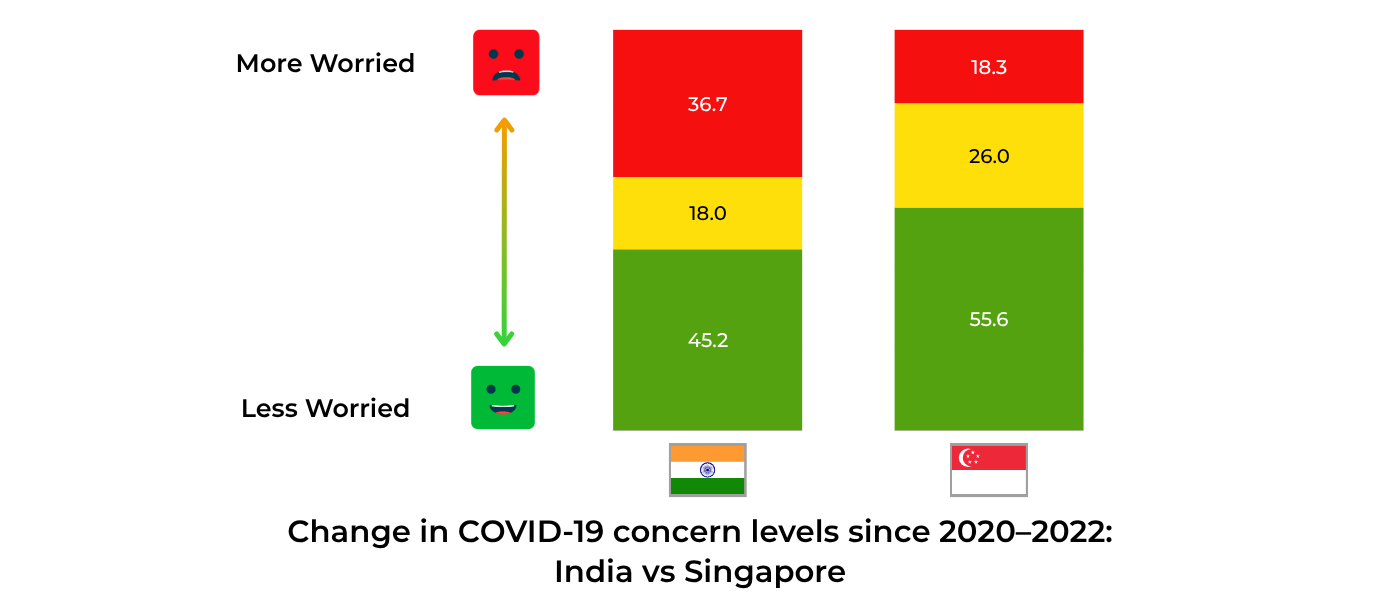

India emotionally affected, Singapore moves on

When asked how worried they are about Covid-19 now compared to previous years, the emotional difference sharpens.

In India, 36.7% say they are more worried now than during past waves, suggesting a lingering vulnerability or fear of history repeating itself. In Singapore, only 18.3% report higher concern, while over 55% say they are less worried than before.

This shift points to emotional resolution in Singapore, versus unresolved trauma and anticipation in India. Indians may be stuck in a post-traumatic cycle, where each new headline reactivates past anxiety.

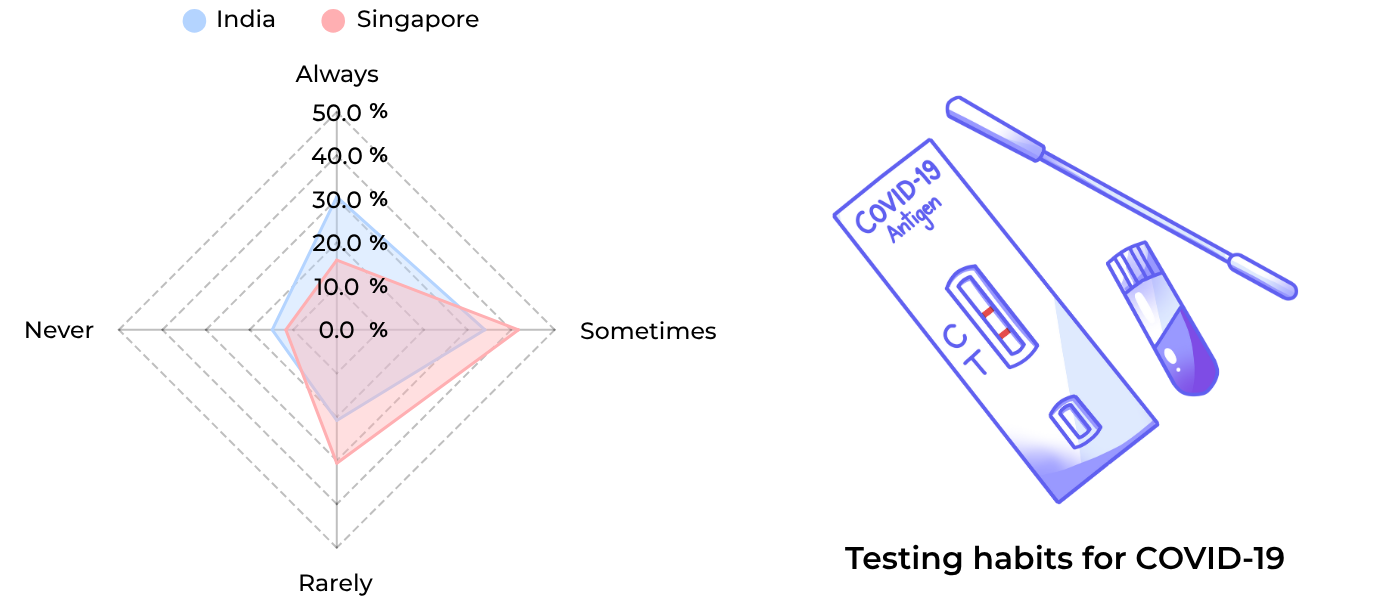

Testing behavior: India is more proactive, Singapore tests contextually

India’s concern translates into action: 30.5% of Indians say they would always test if they felt unwell, compared to just 16% of Singaporeans.

Singaporeans adopt a situational testing model, 41.7% test "sometimes" and 30.6% "rarely", signaling confidence in self-monitoring or a cost-benefit approach to health decisions.

This behavior shift in Singapore reflects not negligence but a recalibrated personal risk lens. Conversely, India treats testing more like a moral and social responsibility, aligned with their stronger concern levels.

Isolation practices: Willingness is similar, logic behind it is different

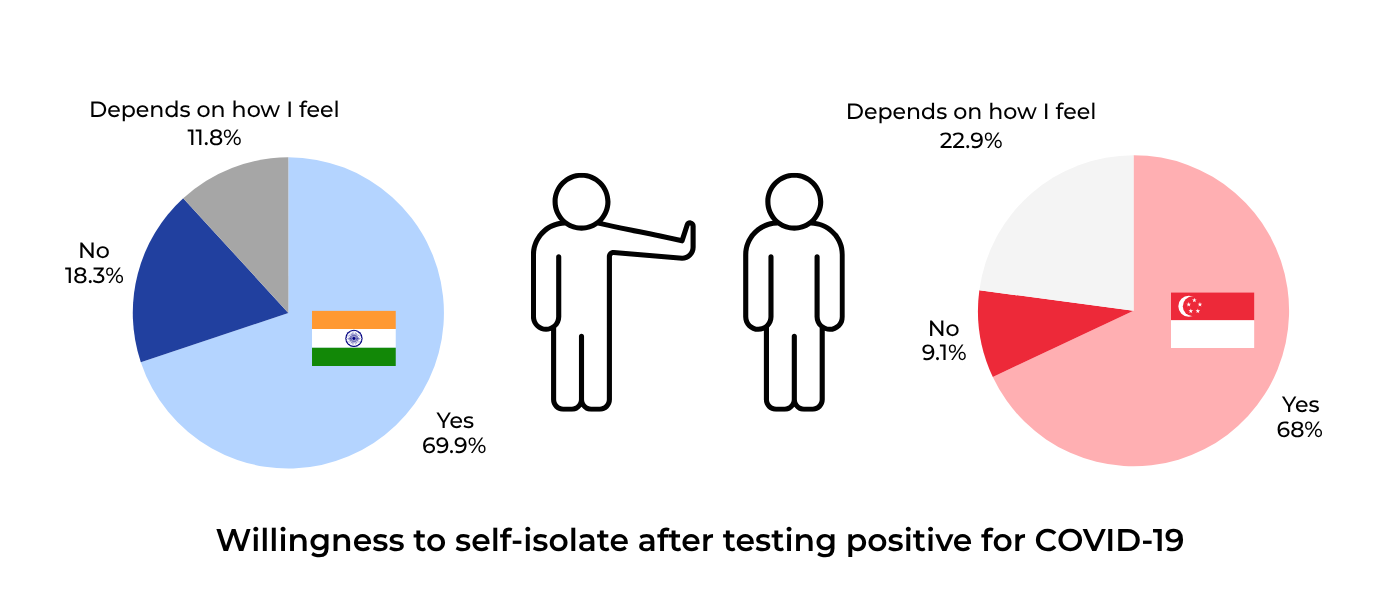

Despite different concern levels, both countries show strong willingness to isolate after testing positive: 69.8% in India, 68% in Singapore.

However, Singaporeans are more conditional, 22.9% would isolate only depending on symptoms, compared to just 11.8% in India. This again mirrors a symptom-centric public in Singapore versus a preventive-minded population in India.

Curiously, India has a higher share of people who wouldn't isolate at all (18.3% vs 9.1% in Singapore), which may hint at resource constraints, household limitations, or economic pressure despite high testing rates.

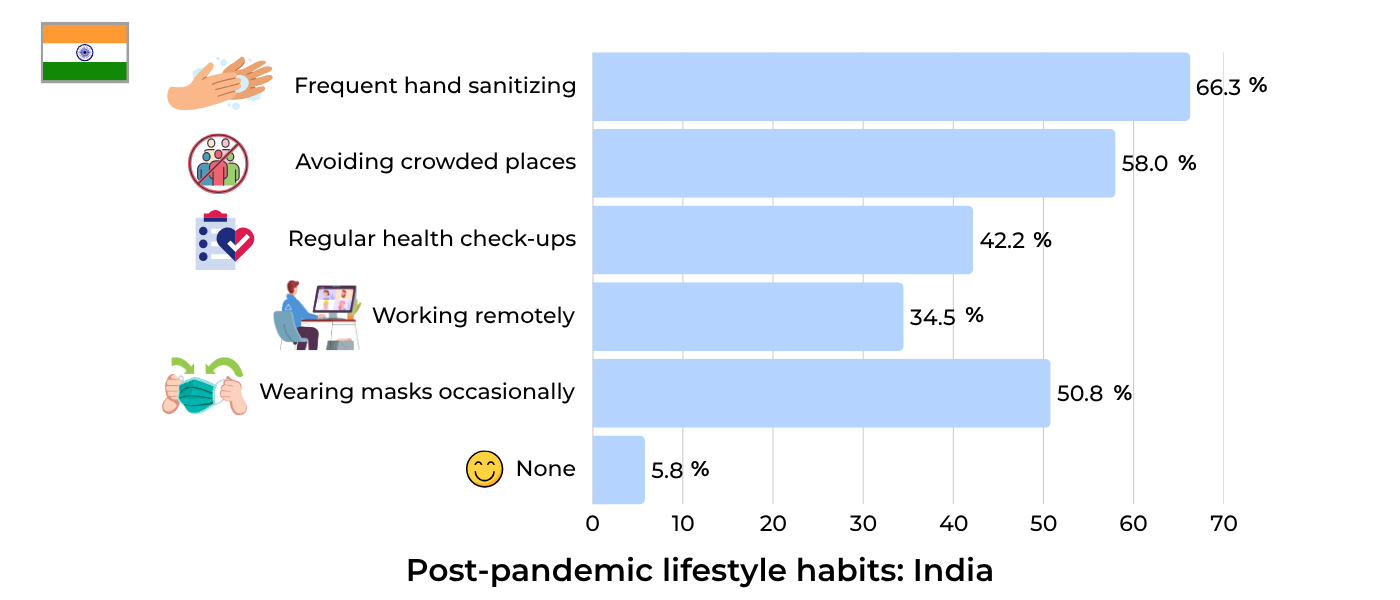

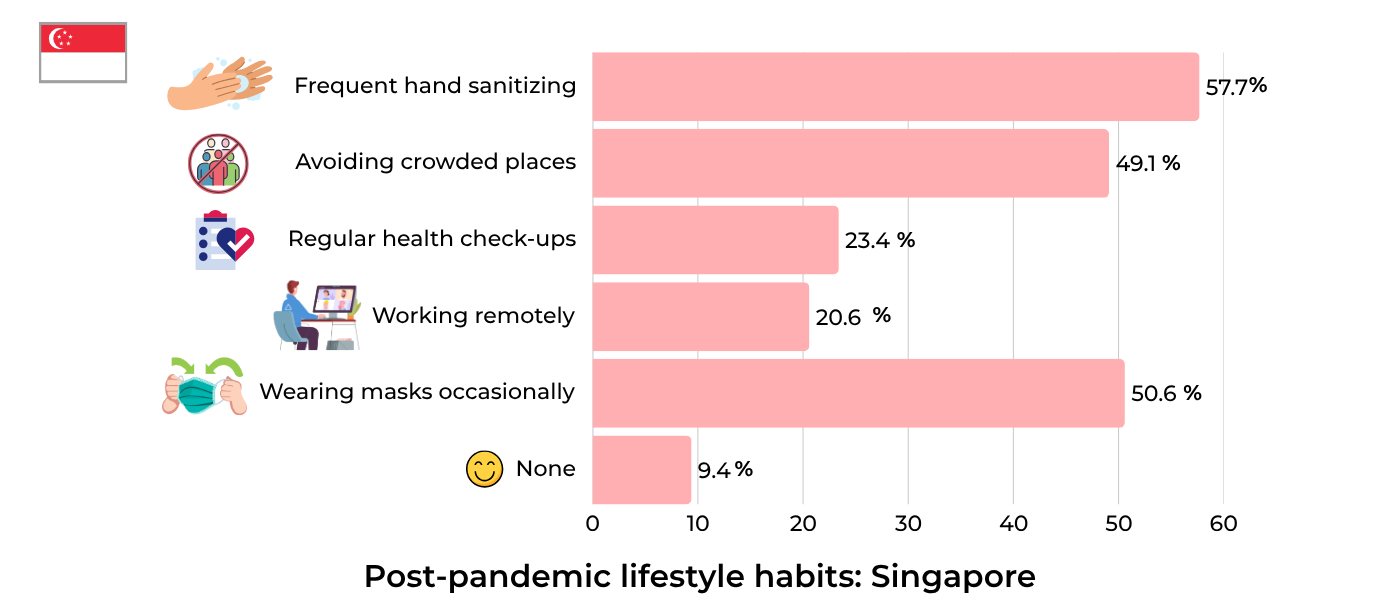

Habit retention: India holds on to safety routines longer

Post-pandemic behaviors show stronger continuity in India, perhaps due to higher perceived risk or societal conditioning.

- Hand sanitizing: 66.3% (IN) vs 57.7% (SG)

- Avoiding crowds: 58% (IN) vs 49.1% (SG)

- Regular health checks: 42.2% (IN) vs 23.4% (SG)

- Remote work: 34.5% (IN) vs 20.6% (SG)

Singapore has moved toward normalcy faster, 9.4% have dropped all Covid-related habits, compared to 5.8% in India.

These behaviors indicate that Indians are not just concerned but have institutionalized their caution into daily routines, especially in public spaces where density is high and trust in ventilation or hygiene infrastructure is lower.

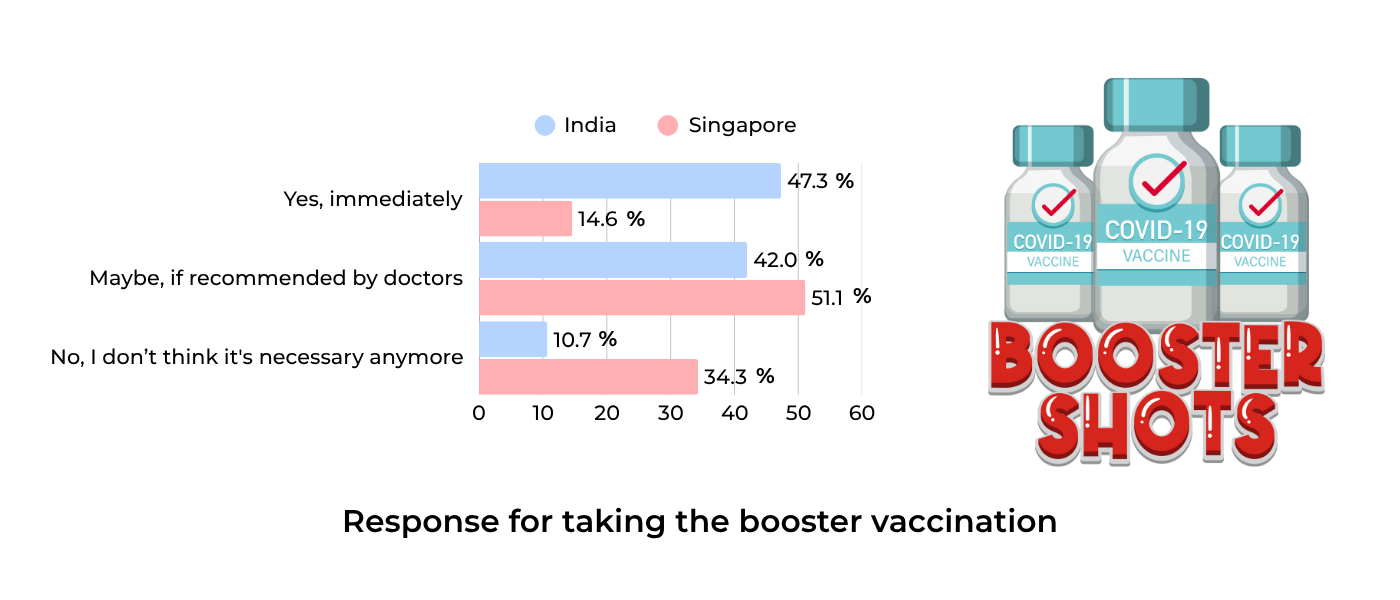

Vaccination readiness: India is more booster-positive

Recent booster uptake shows stark contrasts:

- India: 31.8% received a booster in the past year

- Singapore: just 11.7%

Looking ahead, 89.3% of Indians are open to receiving a new booster (either immediately or conditionally), while over one-third of Singaporeans (34.3%) say they wouldn’t take another booster, citing reduced need, fatigue, or waning trust.

Singapore’s low urgency may indicate a sense of safety, while India sees boosters as continued protection in an unpredictable health landscape.

Motivations behind booster uptake: Institutional trust vs personal judgment

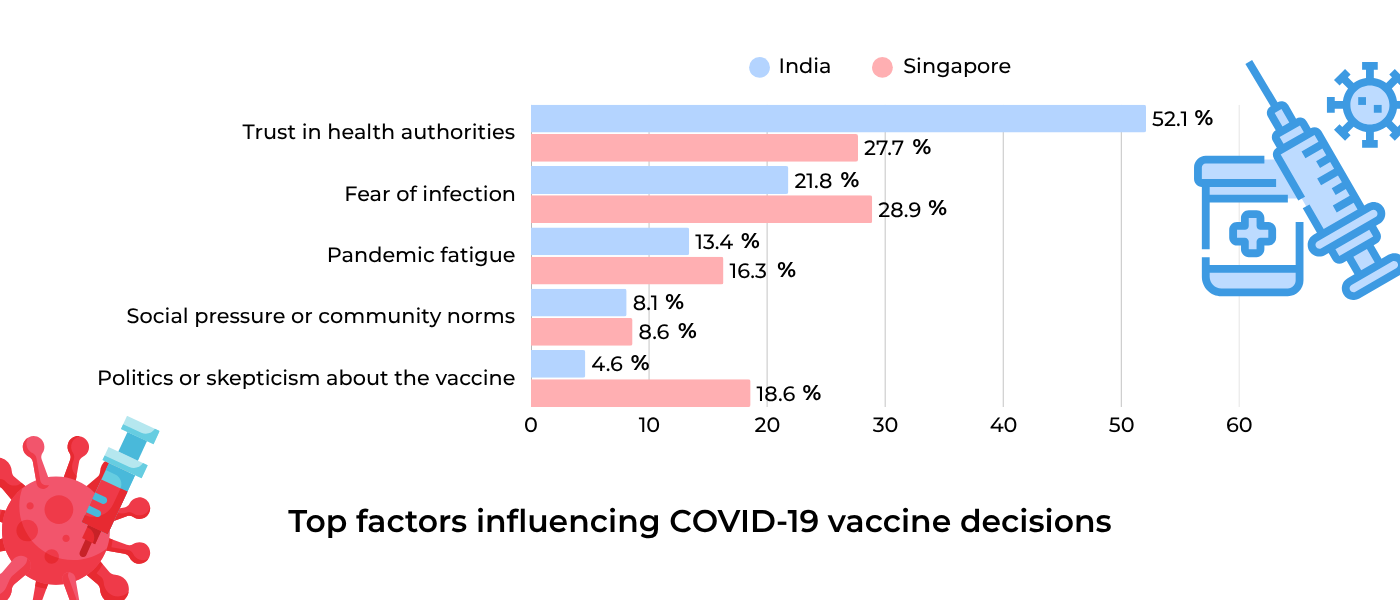

When asked what would motivate them to get boosted again, the differences were striking:

- India: 52.1% said "I trust authorities so I’ll take it"

- Singapore: only 27.7% chose the same, while 28.9% said "Only if I’m scared of getting infected"

Trust in public health messaging appears stronger in India, while Singapore shows signs of institutional detachment.

Furthermore, 18.6% of Singaporeans reported distrust in the vaccine or political factors, a notable concern that may reflect growing vaccine skepticism post-pandemic.

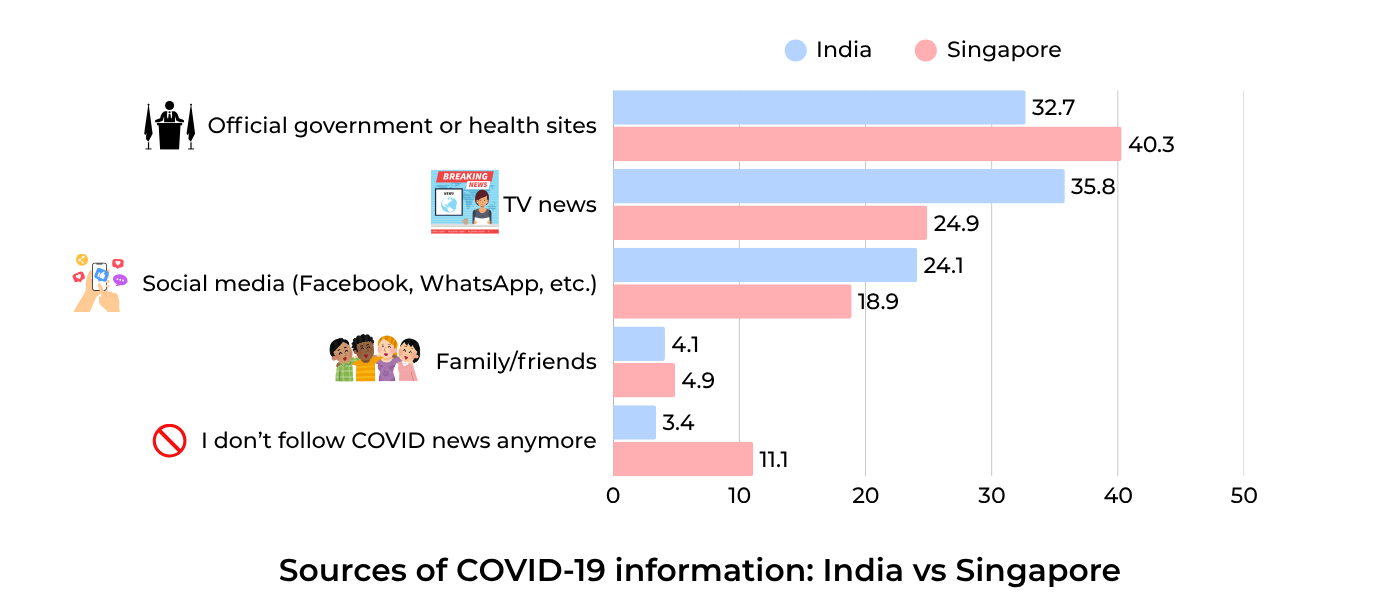

Covid information sources: Singapore disengages faster

In India, TV news remains the top Covid-19 information source (35.8%), closely followed by official government or health websites (32.7%). Social media plays a moderate role (24.1%), indicating that while Indians engage with multiple sources, institutional and centralized channels still play a strong role in shaping public awareness. This balance contrasts with Singapore, where a greater share relies on official websites (40.3%), but a higher portion has disengaged from Covid-related information altogether (11.1% in Singapore vs. 3.4% in India).

Revisiting the root of heightened concern: The role of parenthood

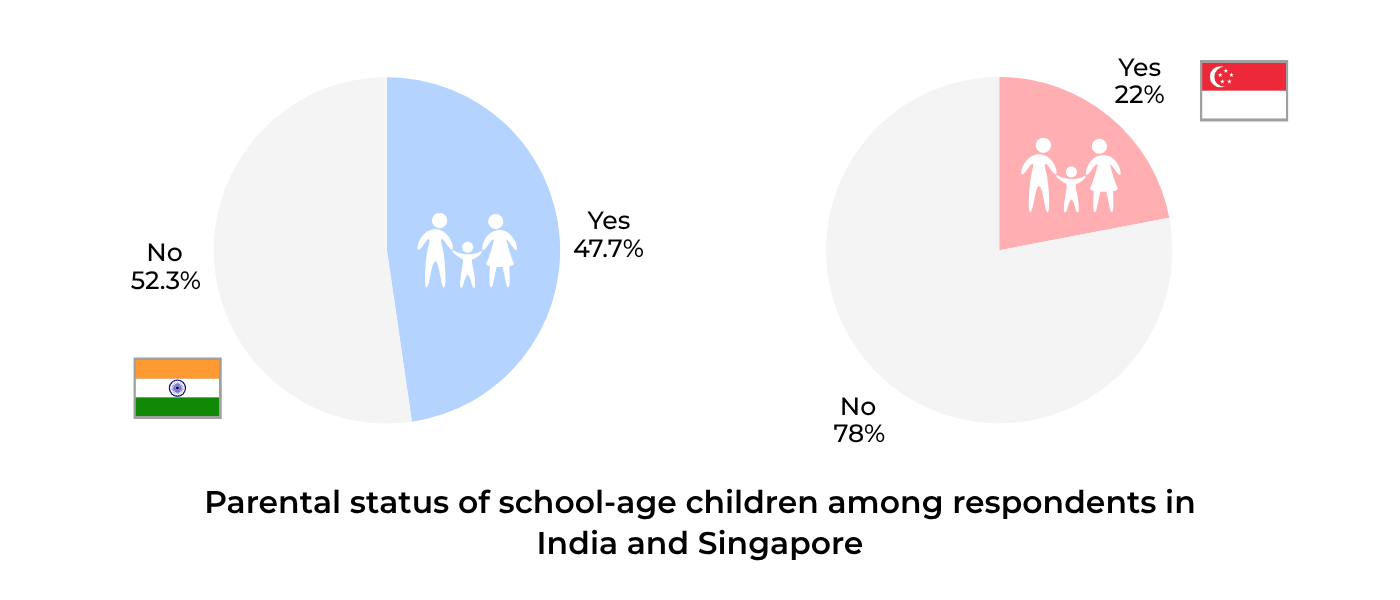

After examining all behavioral data - levels of concern, testing habits, booster readiness, and hygiene practices, one underlying demographic pattern may help explain why Indian respondents consistently show higher alertness: parenthood.

The survey shows that 47.7% of Indian respondents are parents of school-age children, more than double the proportion in Singapore (22%). This significant demographic difference could be a central force shaping emotional and behavioral responses to COVID-related risks in India.

Parents are naturally more vigilant, especially when it comes to protecting their children from illness. In India, where multi-generational households are common, the stakes are even higher: a virus spreading through schools could easily reach vulnerable grandparents at home. This dynamic likely contributes to India's stronger booster acceptance, frequent testing behavior, and retention of hygiene habits, all driven by a heightened sense of collective family protection.

In contrast, Singapore's lower proportion of parents may partly explain the country’s more detached, symptom-based approach. Without the added emotional and logistical responsibility of managing children's health, risk perception becomes more individualized and less reactive.

Conclusion: Two very different pandemic timelines

The latest data from Z.com Research uncovers stark contrasts in public response to the re-emergence of COVID-19 between India and Singapore. Indian respondents consistently display higher levels of concern, testing frequency, and willingness to receive booster shots, driven in part by the country’s traumatic experience during previous COVID waves, higher media coverage, and a deeper trust in health authorities. In contrast, Singaporeans show signs of pandemic fatigue, lower perceived urgency, and a shift toward normalization, reflected in reduced booster uptake, moderate concern levels, and a greater reliance on personal risk assessment rather than institutional guidance.

While both nations demonstrate a baseline awareness of the new variant, India’s continued caution, especially among parents and working-age adults, suggests that past public health crises have left a lasting psychological and behavioral imprint. As the global landscape evolves, understanding these regional nuances is key to crafting effective public health strategies and communication efforts.