Squid Game Season 3: One Global Show, Two Very Different Audiences – A Comparative Insight from India and Singapore

While Squid Game Season 3 sparked excitement across Asia, audience reactions in India and Singapore couldn’t have been more different. This report by Z.com Research, based on insights from 1,299 Indian and 307 Singaporean respondents, explores how a shared cultural moment evolved into two divergent viewing experiences, shaped by accessibility, emotional appetite, and broader social context.

Where Indian viewers dove in with high emotional engagement and social enthusiasm, Singaporeans responded with cautious selectivity and measured reflection. These differences offer valuable insights into how global content must navigate local sensibilities to resonate fully.

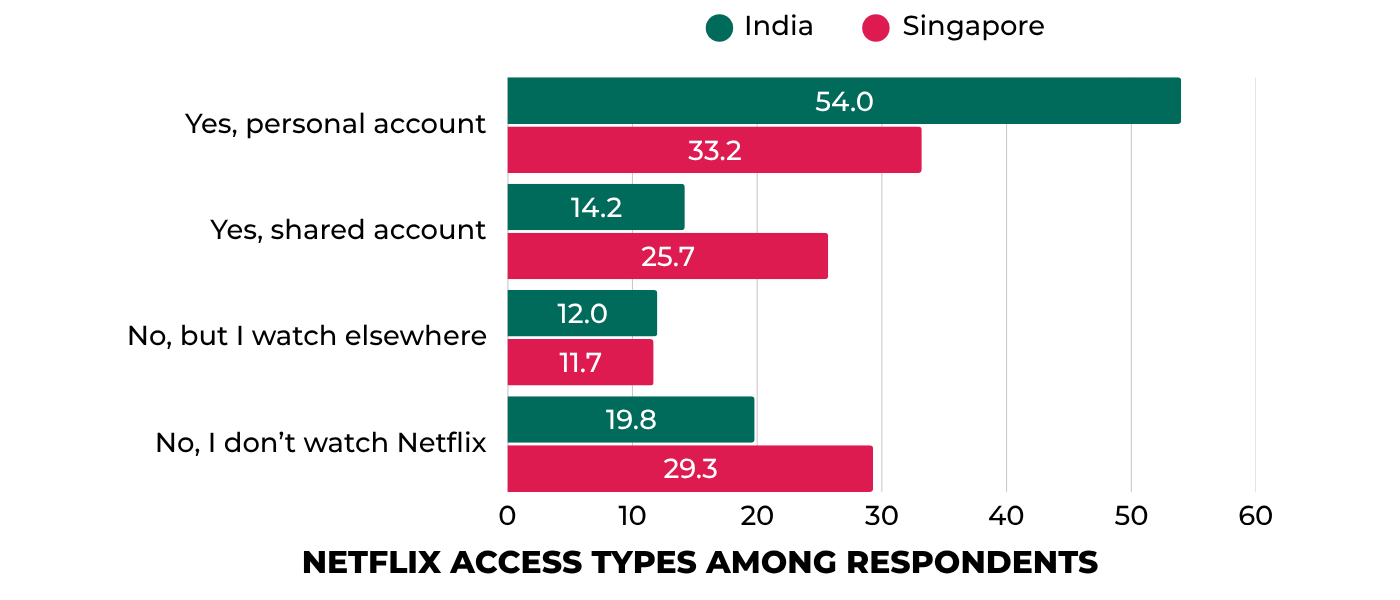

Access to Netflix shapes content engagement

India: A high-access market fuels stronger engagement

In India, 68.2% of respondents have access to Netflix, either through a personal (54%) or shared account (14.2%). This widespread availability likely contributes to higher awareness and consumption of international content. Even among the 12% who don’t have a Netflix account, many still find ways to watch popular shows through YouTube clips, Telegram links, or social media memes. Only 19.8% say they don’t watch Netflix at all.

This easy access creates fertile ground for global hits like Squid Game to take off. Viewers are more likely to keep up with trending content, helping shows maintain momentum across multiple seasons. The strong viewership into Season 3 suggests that once Indian viewers are invested, they stay loyal.

Singapore: Lower access, more selective viewing

In contrast, Netflix penetration is noticeably lower in Singapore. Only 33.2% have a personal account, although a higher proportion (25.7%) share access with others. Still, nearly three in ten (29.3%) don’t watch Netflix at all a significant figure that limits the organic spread of streaming trends.

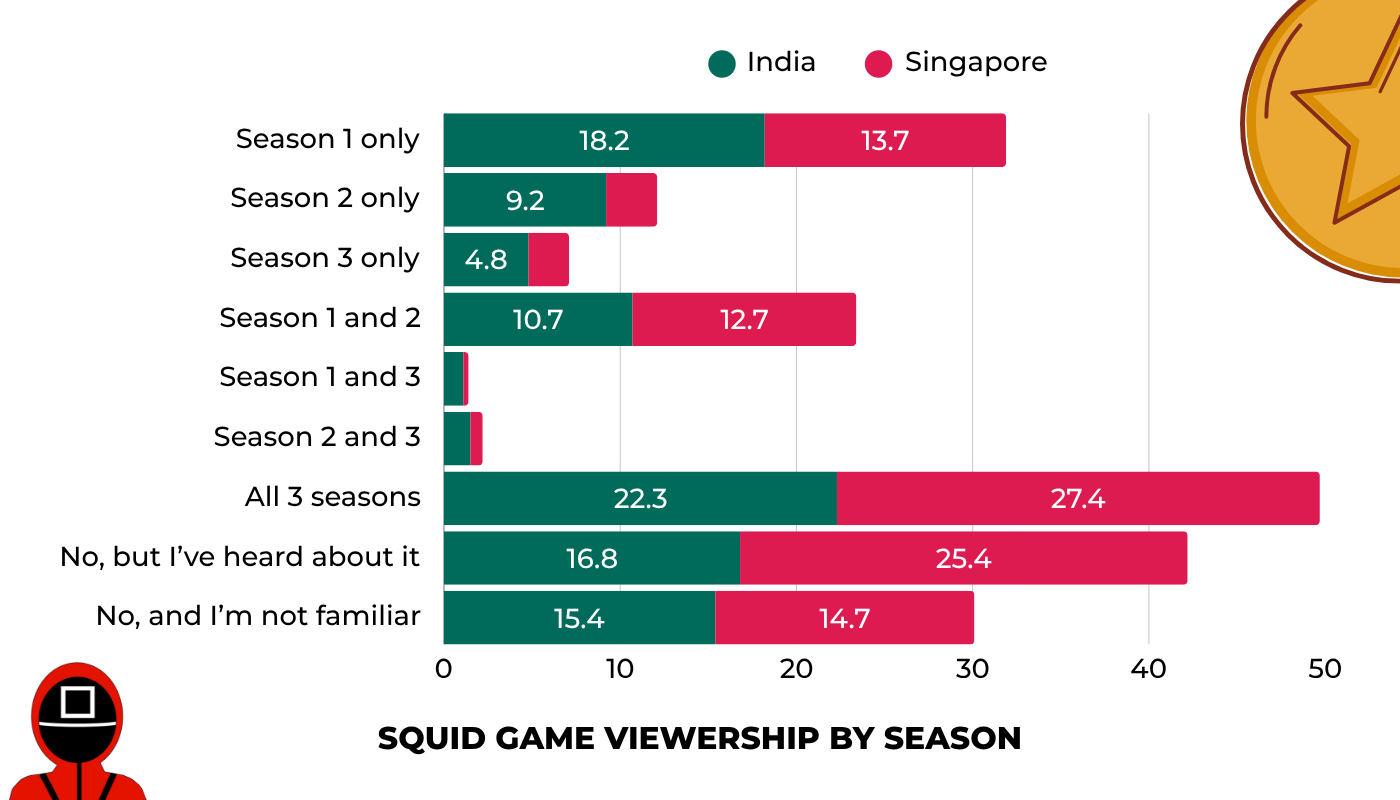

Despite that, Squid Game has clearly made its mark. Around a quarter (25.4%) have heard of the show but never watched it, pointing to its wide cultural recognition. But unlike in India, where mass awareness often translates to viewership, Singaporean audiences appear more discerning. Content needs to earn their time and even global buzz may not guarantee a watch.

Yet among those who do watch, commitment runs deep. Interestingly, 27.4% of Singaporeans have seen all three seasons, slightly higher than the 22.3% in India. This suggests that when Singaporean viewers do buy into a show, they stay engaged across its evolution.

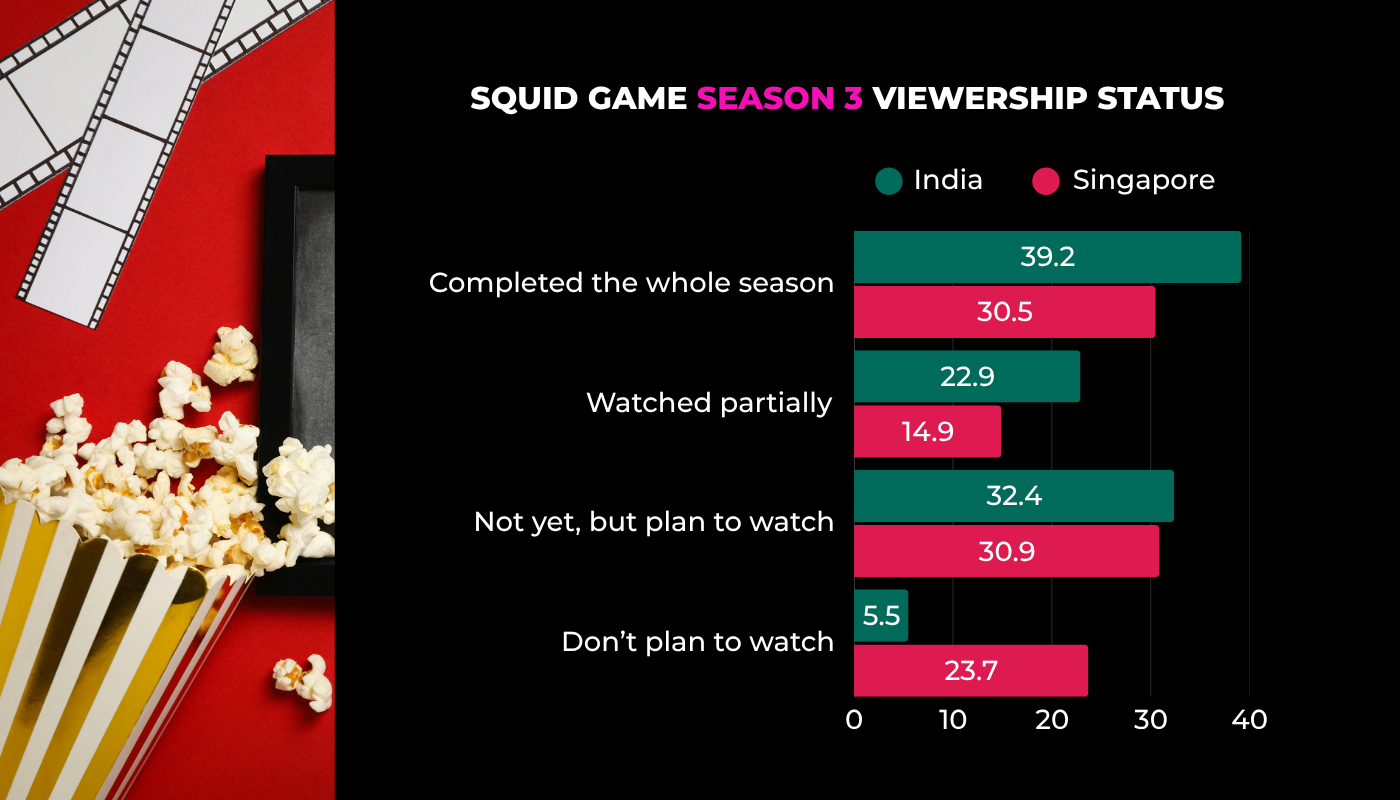

Squid Game 3: A cultural hit in India, but more divisive in Singapore

The release of Squid Game Season 3 in June 2025 sparked strong reactions across Asia but public response varied sharply between India and Singapore.

In India, excitement was clearly high: nearly 2 in 3 respondents (62.1%) had already started watching, with 39.2% having finished the entire season. Even among those who hadn’t yet tuned in, the majority expressed plans to watch soon, pointing to sustained interest in the franchise.

In contrast, Singaporean audiences appeared more hesitant, with only 30.5% having completed the new season and almost 1 in 4 (23.7%) saying they had no intention of watching it at all.

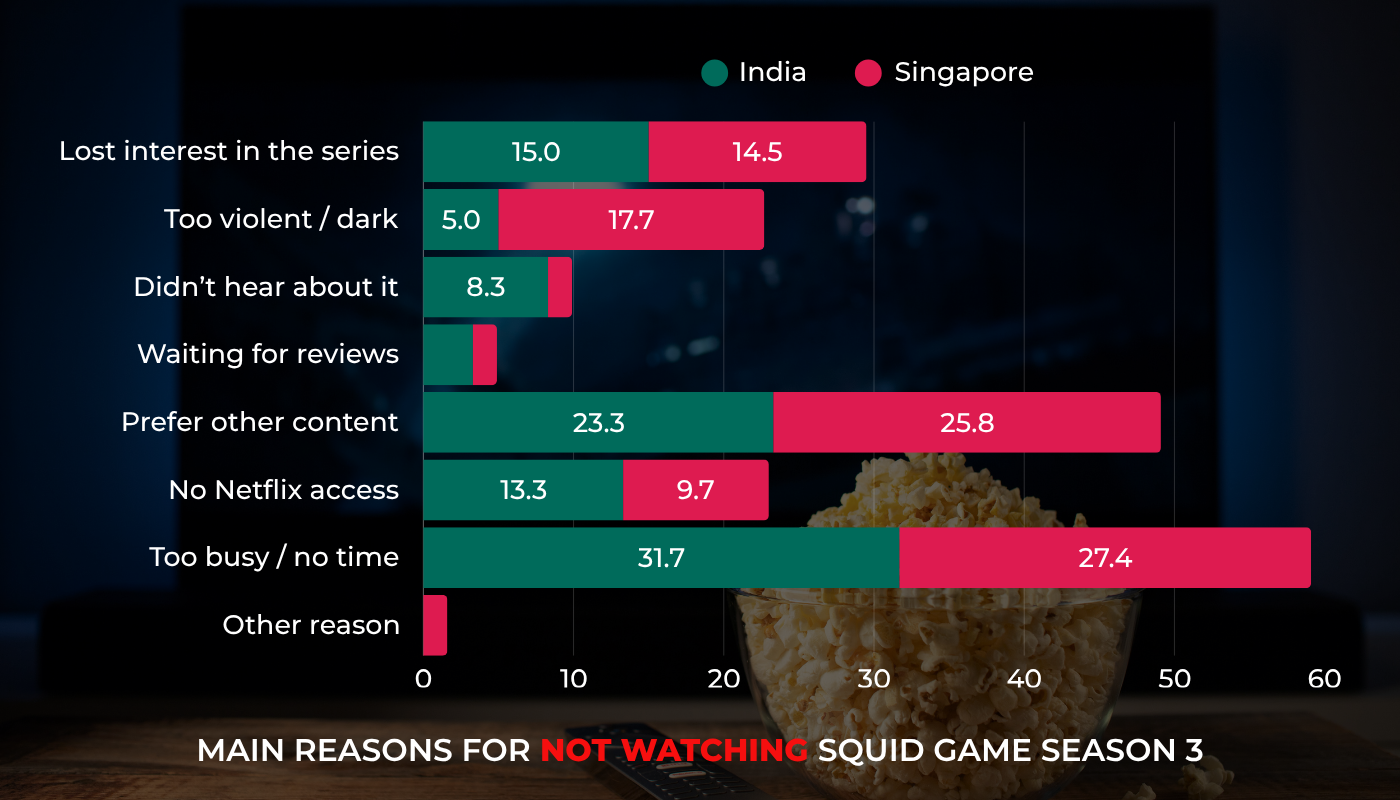

Why some chose to skip Squid Game Season 3

Time and taste: the top barriers

Across both countries, the top reason for not watching Season 3 is simple: they’re too busy. About 1 in 3 non-viewers in India (31.7%) and Singapore (27.4%) cited a lack of time. Other leading reasons include shifting content preferences, many now prefer other shows (India: 23.3%, Singapore: 25.8%) and lost interest in the series over time.

Singapore shows more sensitivity to dark content

Notably, 17.7% of Singaporeans who skipped the season say it’s too violent or dark, compared to just 5% in India. This aligns with Singapore’s broader preference for lighter genres, a pattern echoed in their top streaming choices. The data suggests that beyond time and access issues, tone and theme matter more to Singapore viewers when deciding what to watch.

What drives people to hit play?

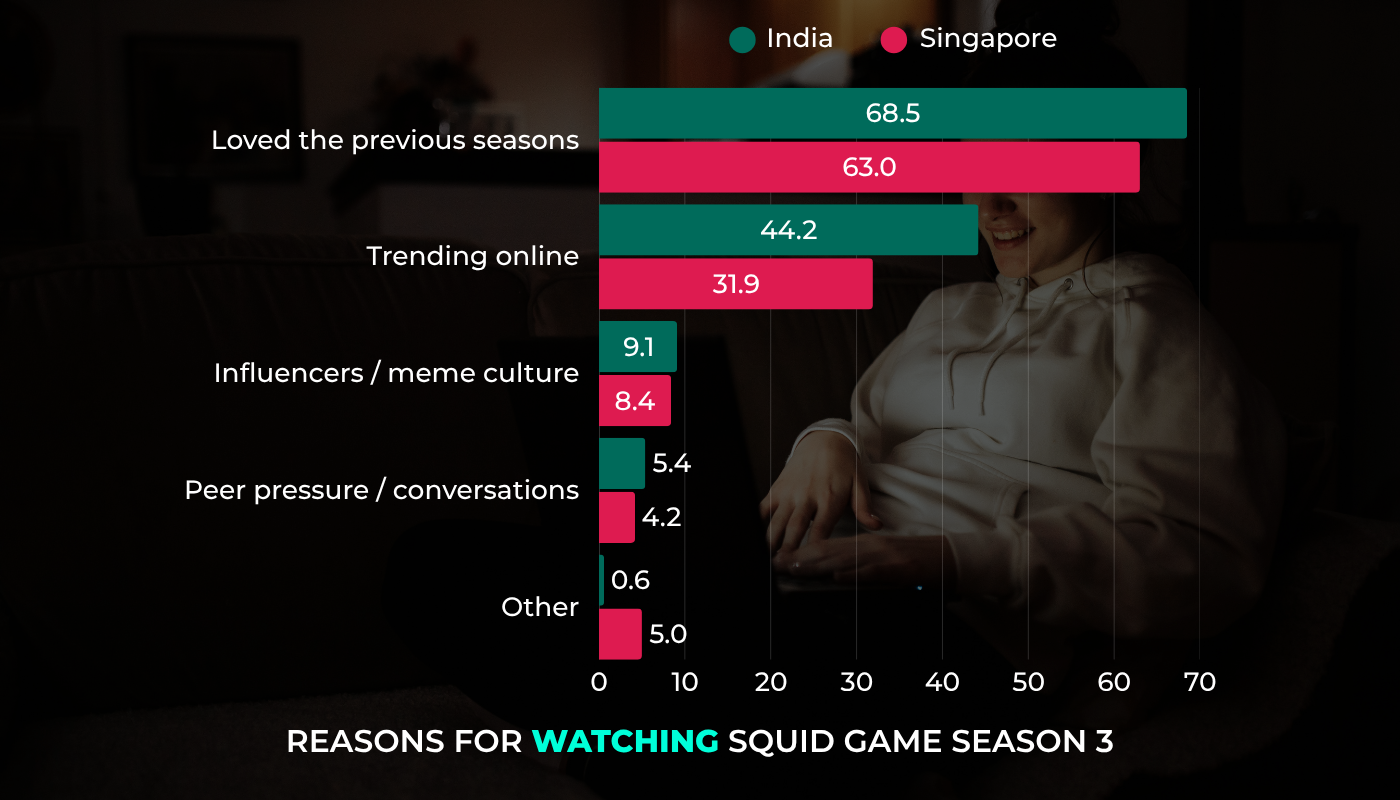

Previous seasons’ success is a major draw

Among those who chose to watch Season 3, the biggest motivator by far was a love for the earlier seasons: 68.5% in India and 63% in Singapore said this was why they returned. This shows how strong storytelling and emotional investment can fuel ongoing viewership even in an oversaturated content landscape.

Hype matters more in India

Indian audiences were also more influenced by online buzz and social media hype: 44.2% mentioned it as a reason for watching, compared to just 31.9% in Singapore. Meme culture and influencer chatter had some influence in both markets, but again, India led slightly (9.1% vs. 8.4%).

In Singapore, audiences seem less responsive to viral trends, possibly due to the older age skew of the sample or more selective viewing habits. Instead of following the crowd, they may be choosing shows that align with their personal tastes and viewing routines.

Viewer sentiment toward Season 3 was sharply split between India and Singapore

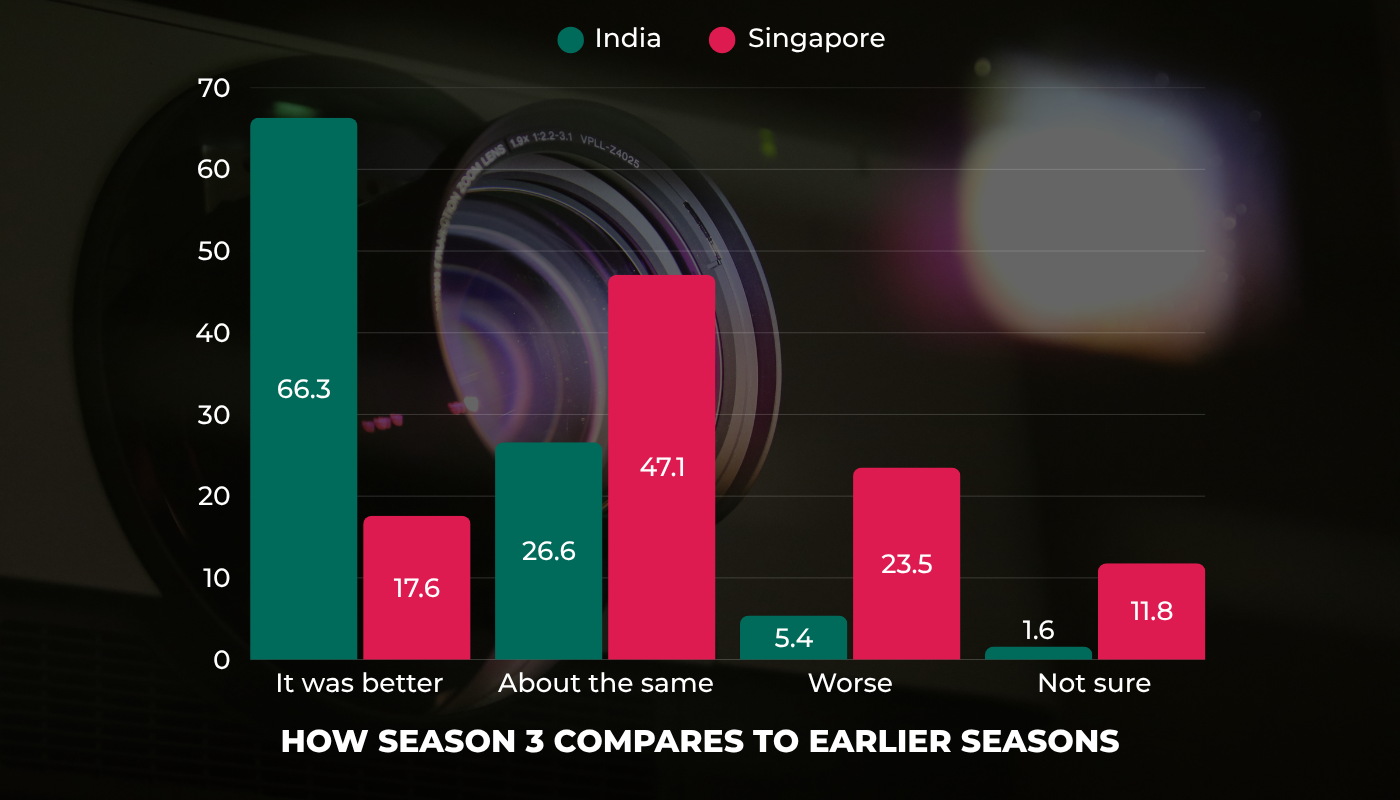

Indian viewers embraced Season 3 as an upgrade

Roughly two-thirds of Indian respondents (66.3%) felt that Season 3 was better than previous seasons. This strong positive response highlights the series' success in sustaining its appeal through compelling new game twists, engaging characters, and emotionally impactful moments such as childbirth or moral dilemmas. Very few said “nothing stood out,” indicating high narrative and emotional engagement.

The show’s signature tension, unpredictable turns, and fresh character arcs resonated well with the Indian audience, especially those who tend to binge-watch and emotionally invest in storylines. This aligns with their earlier strong intent to watch and high reaction to online trends.

Singaporean viewers were more reserved and critical

By contrast, only 17.6% of Singaporeans said Season 3 was better, while nearly 1 in 4 (23.5%) said it was worse than previous seasons. Nearly half (47.1%) found it “about the same,” signaling lukewarm reception. This muted enthusiasm may reflect genre fatigue or unmet expectations.

Singapore’s viewer base was generally less excited by Season 3’s action and twists. Their criticism might be tied to slower pacing, less connection with new characters, or the emotional tone of the season suggesting a mismatch between content and their viewing preferences.

What made the strongest impression?

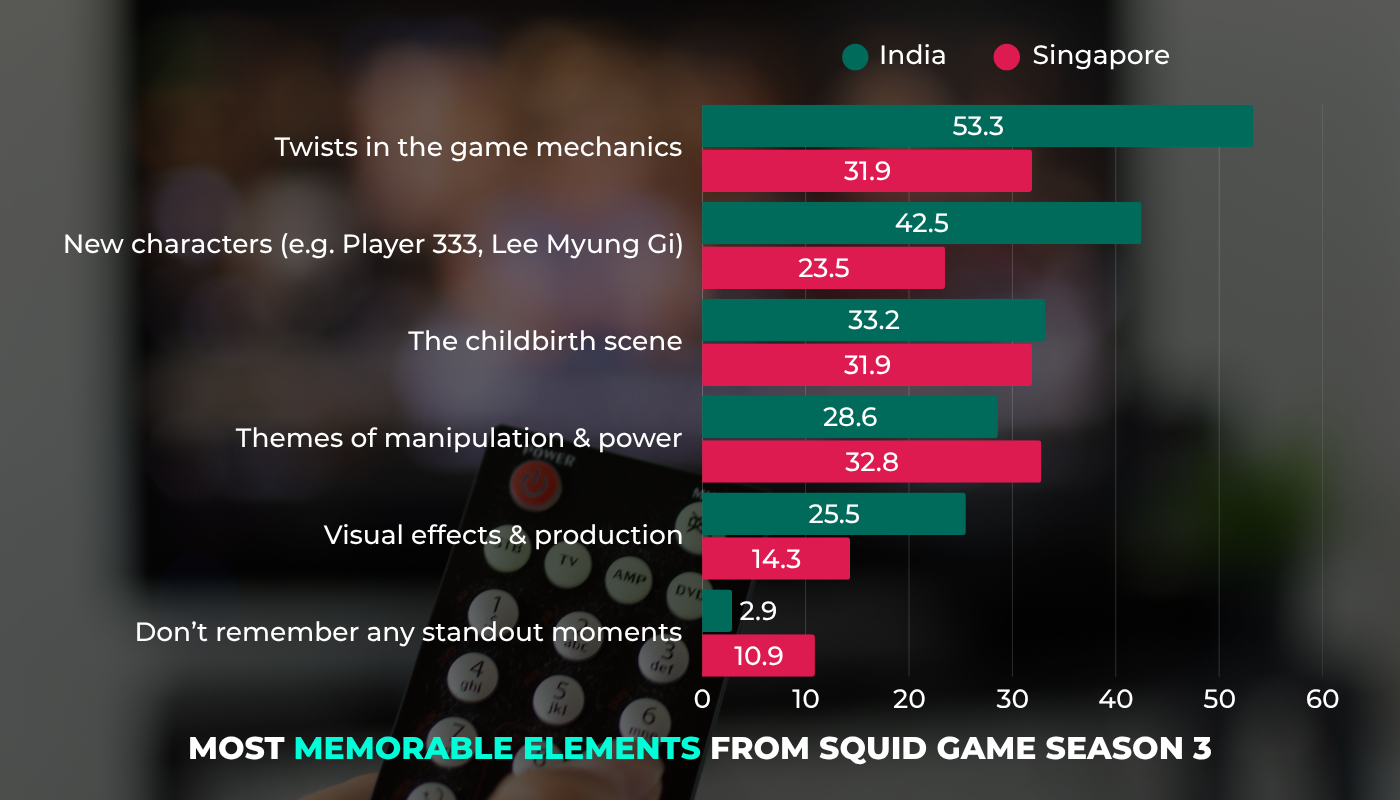

Game twists and characters impressed Indian audiences most

When asked which elements left the biggest impression, Indian viewers overwhelmingly chose twists in the game mechanics (53.3%), followed by new characters like Player 333 or Lee Myung Gi (42.5%). This shows that for them, Season 3 successfully built on its strengths, tense strategy, new players, and high-stakes competition.

The childbirth scene (33.2%) was also notably impactful, hinting at deeper emotional engagement and perhaps cultural resonance around themes of sacrifice, parenthood, or resilience.

Singaporean viewers focused more on themes than spectacle

In Singapore, while game twists and the childbirth scene still made an impression (31.9%), viewers were slightly more drawn to themes of manipulation and power (32.8%) suggesting a preference for psychological or symbolic storytelling over adrenaline-driven plots.

Interestingly, 10.9% of Singaporeans said “nothing stood out,” a number notably higher than India’s 2.9%. This reflects the broader hesitance and underwhelmed sentiment observed in earlier responses, possibly due to pacing issues, lower emotional connection, or content overload.

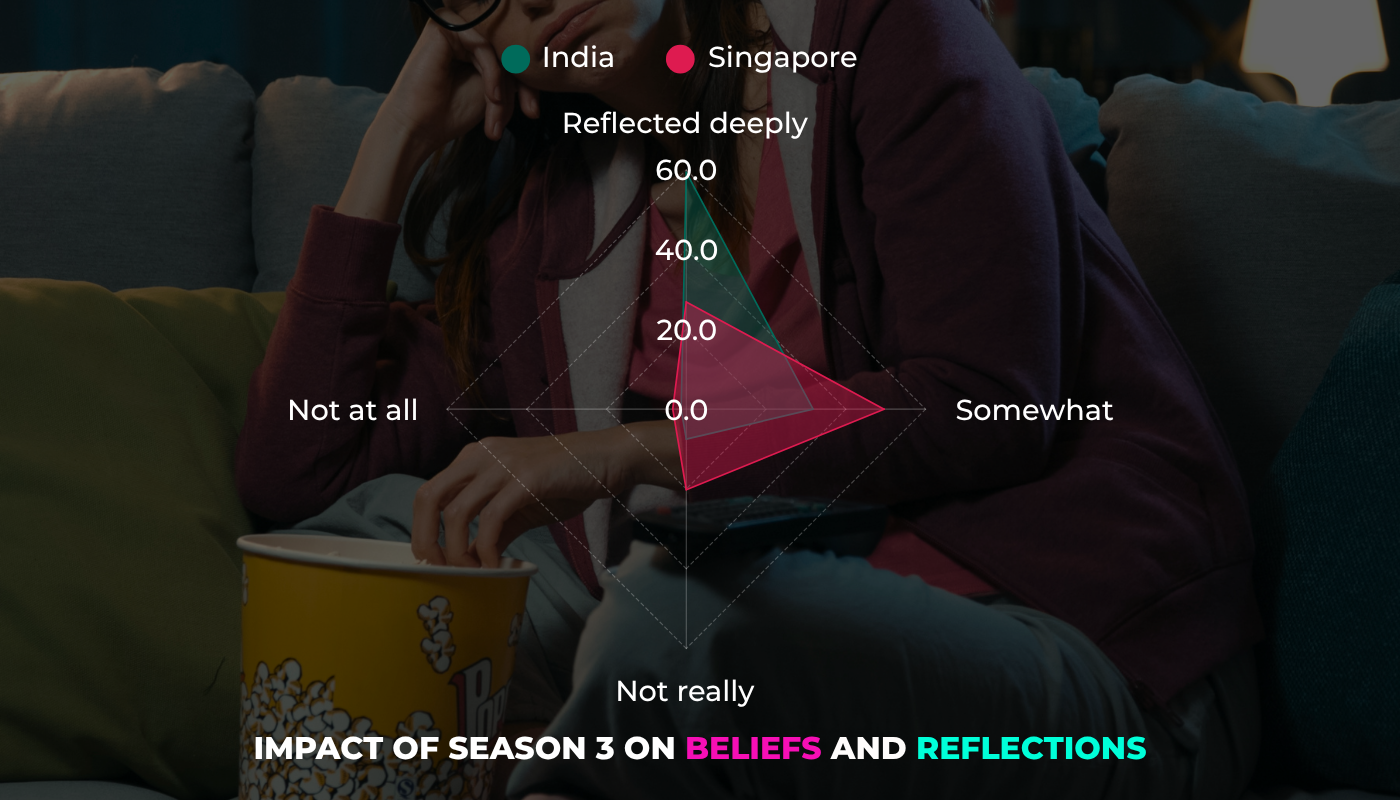

Deeper moral impact in India vs lighter reflection in Singapore

Indian viewers: A mirror to real-life struggles

Over 91% of Indian viewers said the show made them reflect either deeply or somewhat on complex human issues like morality, survival instincts, and ethical choices under pressure. The characters’ morally grey decisions and emotional dilemmas weren’t just dramatic; they felt personal and relatable. For many, the show served as more than entertainment, it echoed the realities of inequality, desperation, and societal pressure.

Singaporean viewers: Thoughtful, but less emotionally invested

In Singapore, the emotional weight didn’t land quite as strongly. Only 26.9% said they reflected deeply on the themes, and 23.6% said they didn’t reflect much at all. This suggests the show may have been perceived more as dark fiction than moral commentary. Cultural factors could shape how audiences interpret violence and ambiguity, resulting in a more detached, entertainment-driven experience.

Emotional impact and post-viewing behavior

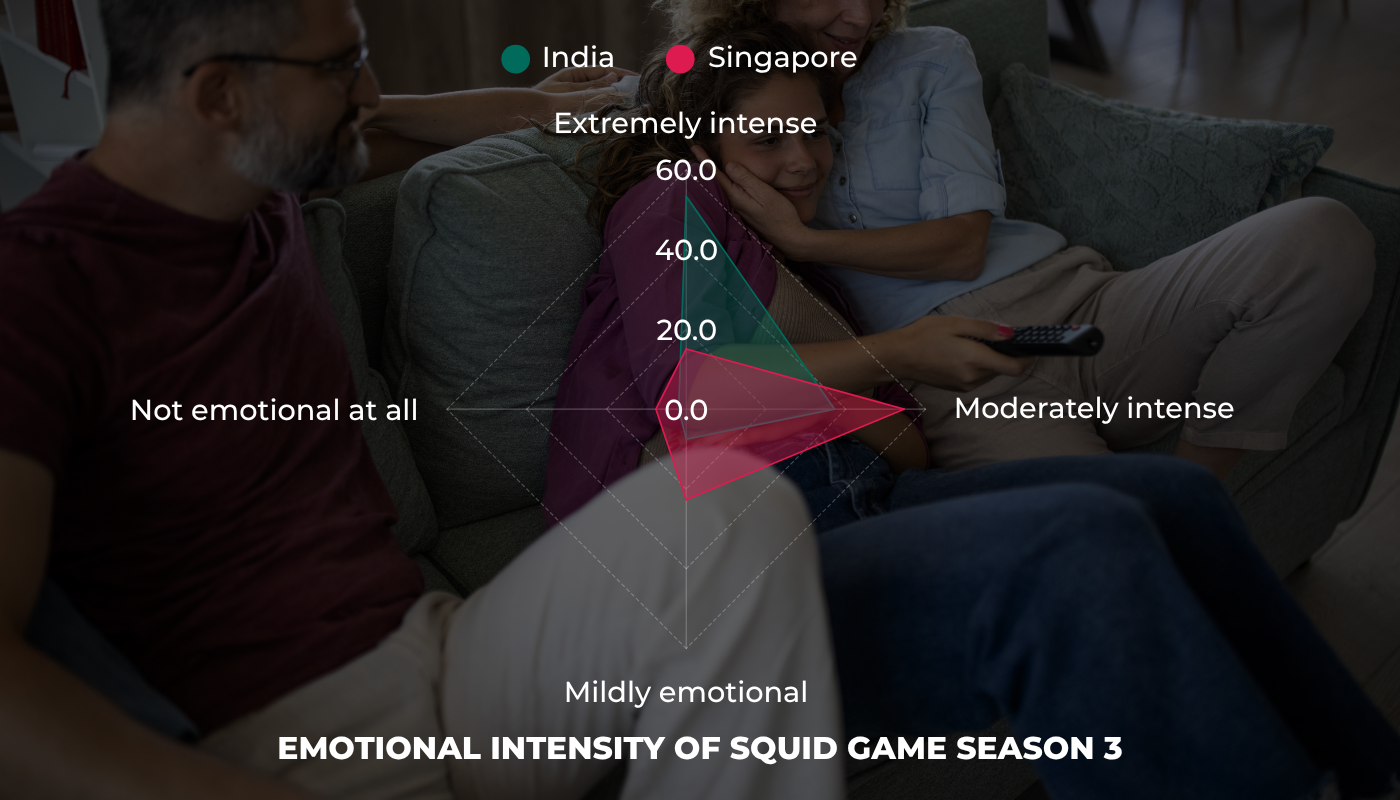

Squid Game 3 hit deep emotional chords in India, but not as much in Singapore

The emotional intensity of Squid Game Season 3 differed sharply between Indian and Singaporean audiences. In India, over 90% of viewers found the season emotionally heavy, with 53.4% describing it as extremely emotional. This wasn't just surface-level engagement, the show clearly struck a nerve. The intensity of the themes, character arcs, and high-stakes survival scenes appears to have deeply resonated.

In contrast, Singaporean viewers were more reserved in their emotional response. Only 15.1% found the show extremely emotional, while a majority (54.6%) described their experience as moderately intense. Notably, over 30% felt little to no emotional reaction, a stark contrast to Indian audiences. This suggests that while Singaporeans engaged with the show, they might have viewed it with more emotional distance, possibly treating it more as suspenseful fiction than a visceral experience.

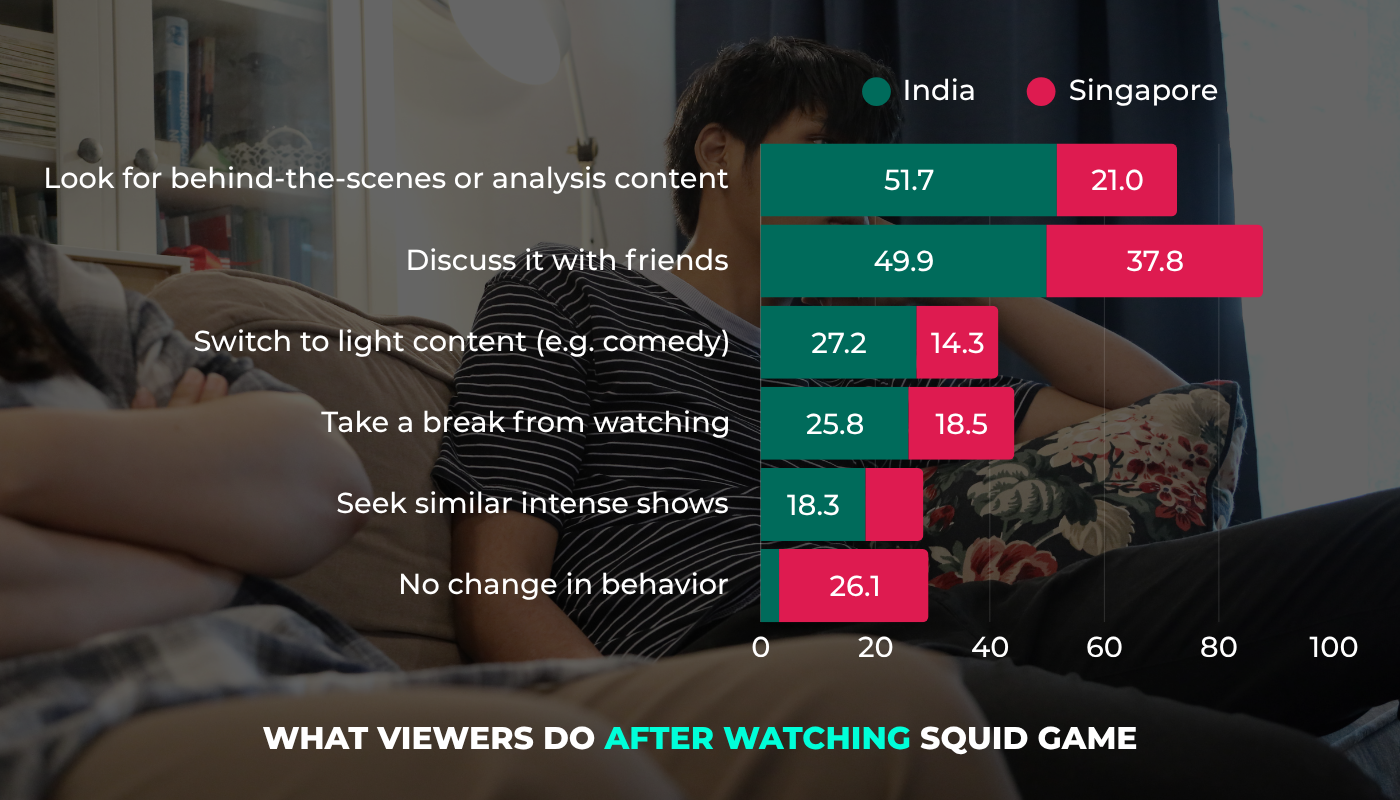

Indian viewers seek deeper meaning and emotional closure

The emotional weight of the show in India didn’t end with the credits. Instead, it led many viewers to actively process what they had just watched. Over half (51.7%) reported seeking out behind-the-scenes content or analysis to better understand the narrative. Nearly 50% said they discussed the show with friends, indicating a strong social dimension to how they dealt with the emotional intensity.

Additionally, Indian viewers reported taking steps to manage their emotional state after the show:

- 27.2% turned to lighter content such as comedy

- 25.8% took breaks from watching entirely

- Some (18.3%) even looked for other intense shows, showing a hunger for similarly gripping narratives

These behaviors show that Squid Game 3 had a lasting effect. It wasn’t just passively consumed, it prompted reflection, discussion, and in many cases, emotional self-regulation.

Singaporean viewers were more likely to disengage and move on

Singaporeans, on the other hand, appeared to process the show very differently. Only 21% looked for analytical content, and just 37.8% discussed it with others, significantly lower than their Indian counterparts. A substantial 26.1% reported no change in behavior after watching, suggesting a tendency to compartmentalize entertainment or a higher emotional threshold.

The fact that fewer Singaporeans sought closure or community discussion hints at a more detached viewing style. While they may have found the show intriguing, it didn’t appear to linger emotionally or demand further engagement.

Demographic drivers behind Squid Game's reach

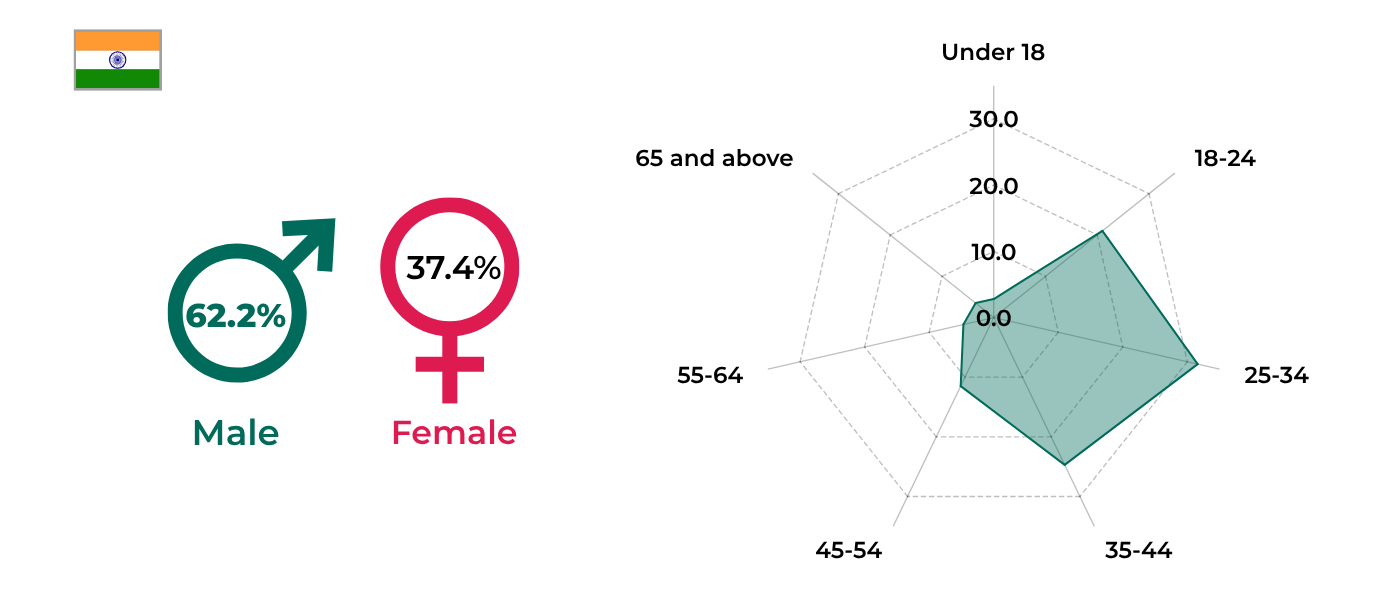

India: Young, male-dominated audience fuels virality

In India, over 55% of respondents are under 35 and 62.2% are male, a segment strongly associated with binge-watching behavior, trend sensitivity, and high digital fluency.

These younger viewers tend to be early adopters of viral content and are highly responsive to online buzz. Many sought out Squid Game even via unofficial platforms such as Telegram or YouTube, showing a strong FOMO-driven culture where staying on top of trends is key to social belonging.

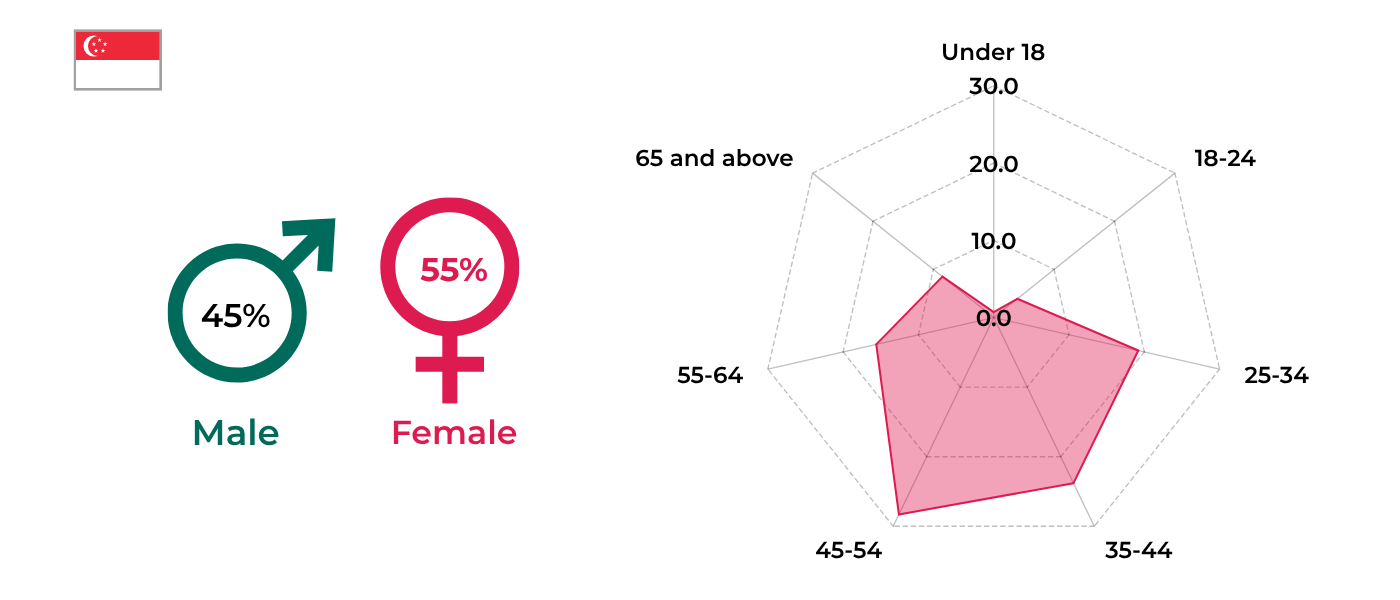

Singapore: Older audience with selective viewing habits

In contrast, 52.4% of Singaporean respondents are aged 45 and above, a demographic that tends to be more deliberate and discerning in their content choices. While awareness of Squid Game was still high, many chose not to watch it. Common reasons cited included “not my type of show,” “don’t have Netflix,” and “too violent.” This suggests a strong genre preference and lower susceptibility to viral trends. However, those who did watch were more likely to finish all seasons, reflecting deeper commitment once engaged.

Streaming habits shape how viewers experience content

In India, streaming is a lifestyle - in Singapore, it’s a leisure activity

Indian viewers are much more embedded in regular streaming behavior. A full 55.4% report watching at least three times a week, with 29.2% watching daily. This suggests that streaming platforms like Netflix are tightly woven into everyday routines, whether for entertainment, emotional connection, or staying in touch with trending stories.

In contrast, Singaporean viewers are more casual streamers. Only 35.2% watch more than three times a week, and nearly 1 in 3 (28.7%) say they stream rarely. Streaming appears to be a less central part of daily life, possibly reserved for weekends or when a particular title catches interest. This more occasional behavior may explain why shows like Squid Game 3, which benefit from consistent viewing and online buzz, had a less intense emotional impact in Singapore.

What drives people to click “play” differs between countries

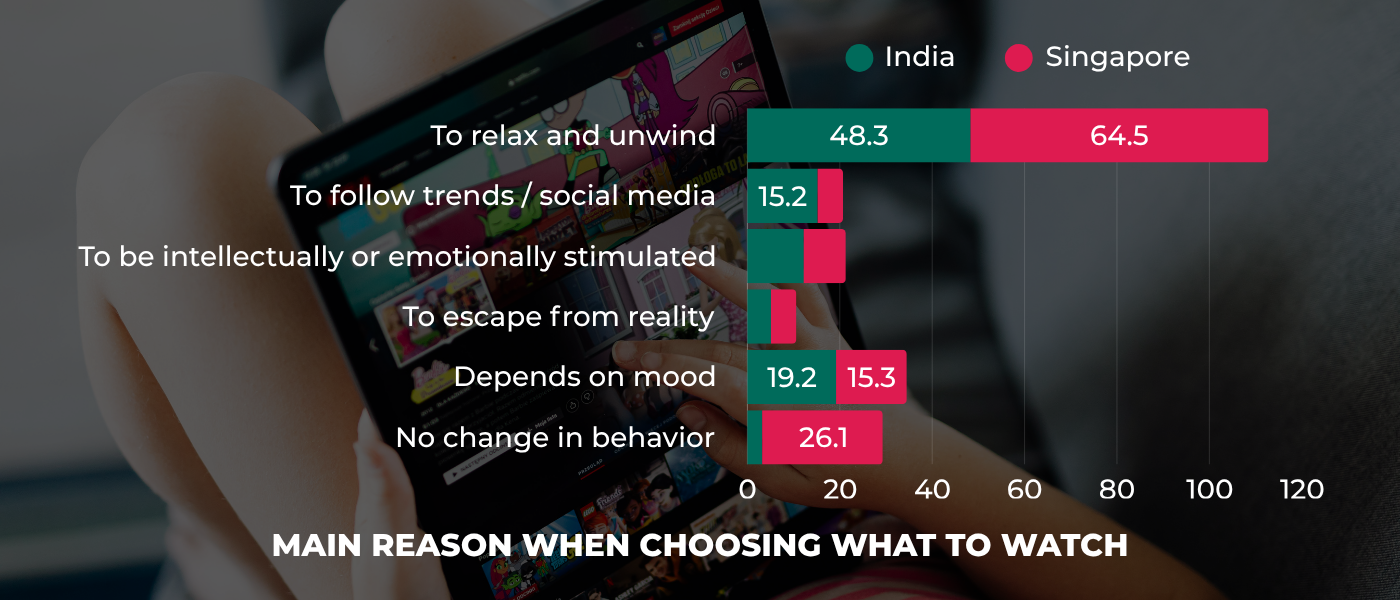

Relaxation is the top reason for streaming in both countries, but it’s notably more dominant in Singapore, where 64.5% say they watch mainly to unwind. For Indian viewers, that number is lower (48.3%), and other motivators play a stronger role. 15.2% watch to stay in tune with trending topics or social media, and 12.2% say they actively seek intellectual or emotional stimulation, a combination that reflects a deeper or more active engagement with what’s being watched.

This difference in motivation helps explain why Indian viewers were more likely to reflect on the moral themes in Squid Game, while Singaporean viewers mostly approached it as escapist content. Shows with social commentary or complex human behavior are more likely to resonate with audiences who are primed to seek that kind of challenge, and in this case, those viewers were far more common in India.

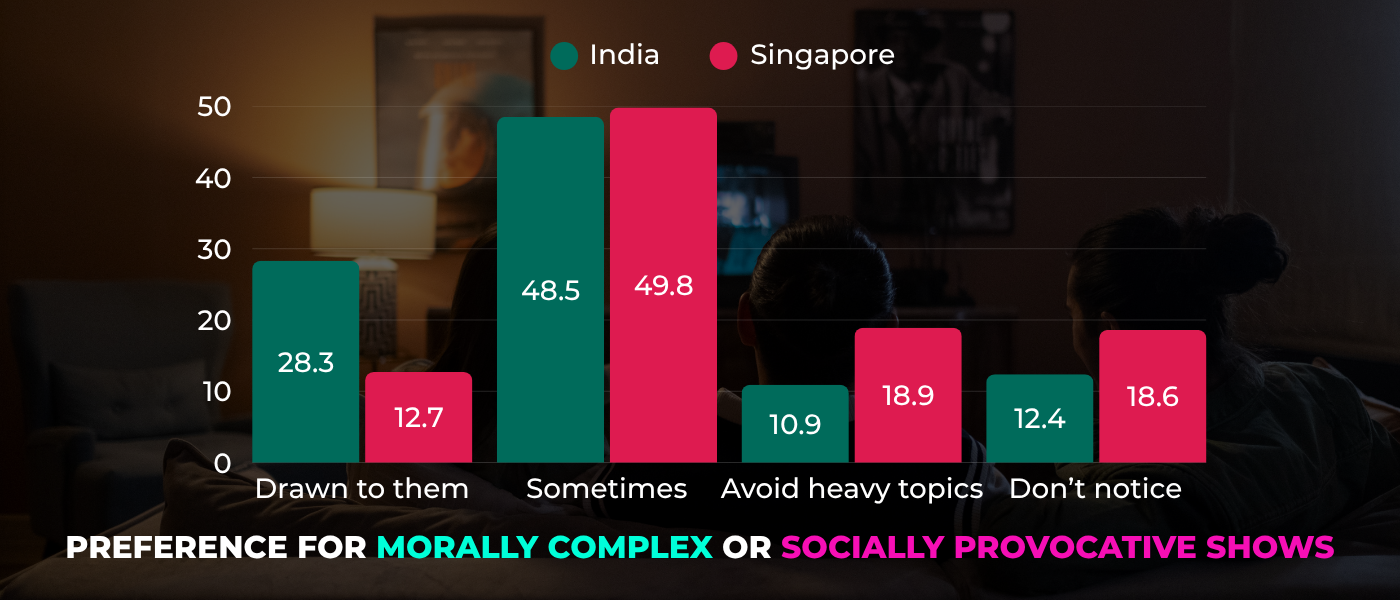

Indian viewers are more drawn to morally complex content

When asked whether they seek out shows that are morally challenging or socially provocative, 28.3% of Indian respondents said yes, they’re drawn to that kind of storytelling. Another 48.5% said sometimes, bringing the total to 76.8% who are open to deeper themes.

In Singapore, only 12.7% actively seek that kind of content, and nearly 1 in 5 (18.9%) say they avoid heavy topics. This reinforces a consistent theme: Singaporean viewers are less emotionally involved, less trend-driven, and less likely to engage deeply with intense or morally grey narratives.

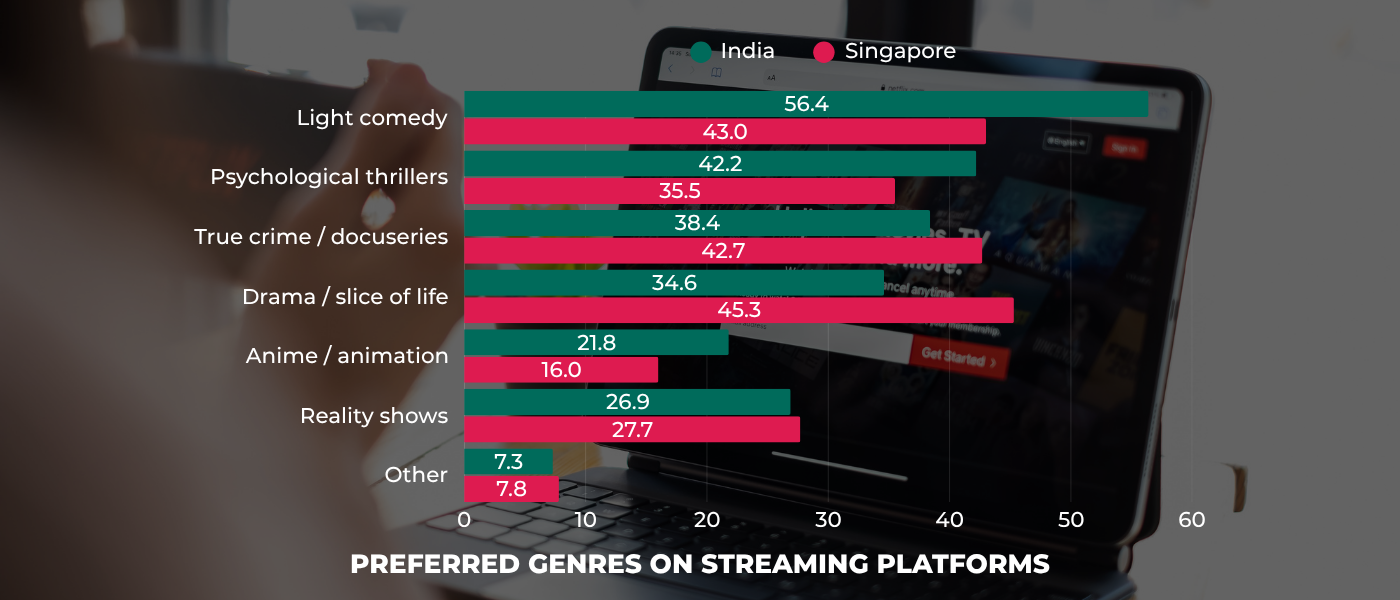

Different genre preferences reflect different emotional appetites

In terms of genre, Indian viewers enjoy a wide range, over half (56.4%) said they watch light comedy, but there’s also strong interest in darker or more serious formats:

- 42.2% enjoy psychological thrillers

- 38.4% watch true crime or docuseries

- 34.6% prefer drama or slice of life

This mix supports the idea that Indian audiences enjoy both emotional intensity and variety, they’re willing to move between comfort and confrontation.

Singaporean viewers leaned more toward realism and emotional grounding. The most popular genres were:

- Drama or slice of life (45.3%)

- True crime / docuseries (42.7%)

- Light comedy (43%)

There’s less emphasis on thrillers or emotionally intense formats. This preference for grounded storytelling and gentle pacing may explain the lower emotional reaction to Squid Game 3, which is driven by tension, competition, and psychological pressure.

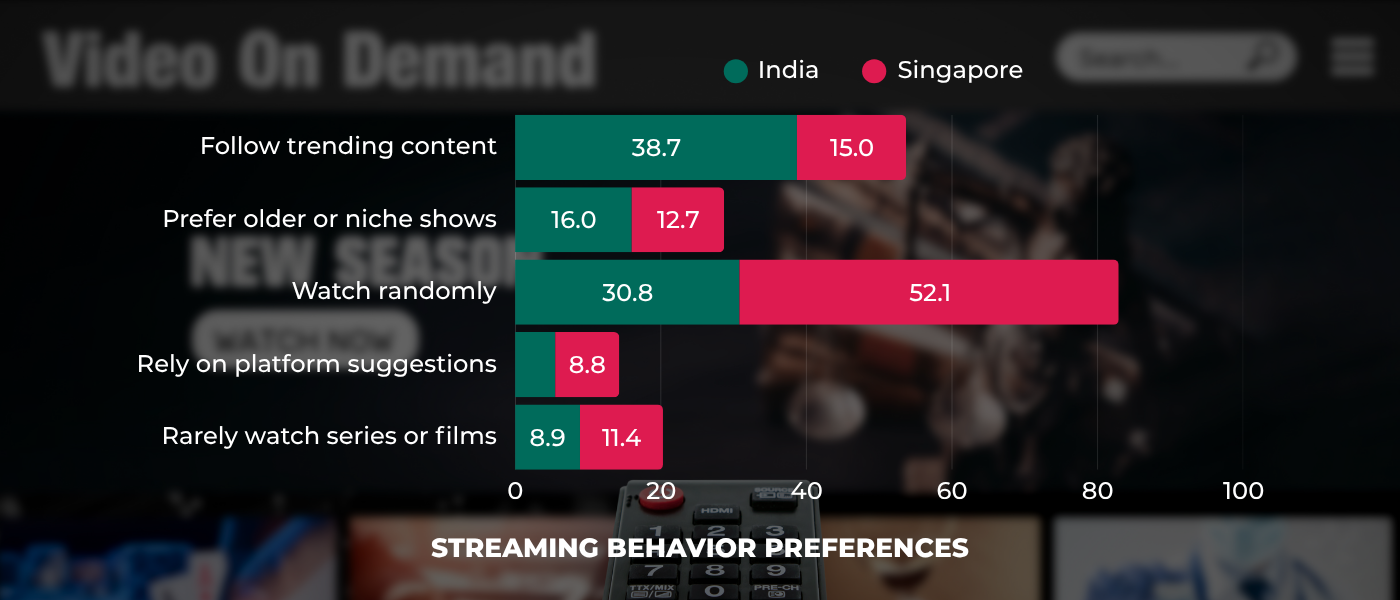

Trends drive viewing in India - discovery drives it in Singapore

Another key difference lies in how people decide what to watch. In India, 38.7% say they follow what's trending online. That means social buzz, recommendations, or cultural conversations can play a major role in getting people to click "play." Another 30.8% say they watch randomly, based on whatever catches their attention in the moment, which still supports high exposure to shows that dominate platform homepages.

Singaporean viewers, however, are much less trend-driven. Only 15% follow online trends. A majority (52.1%) say they decide what to watch on the fly, without a specific plan, often browsing aimlessly or clicking what seems appealing in the moment. This could mean that even a globally popular show like Squid Game needs to compete for attention in Singapore based on first impressions or platform recommendations rather than word-of-mouth momentum.

Conclusion

Squid Game Season 3 was a global hit but audiences in India and Singapore reacted in different ways. Indian viewers, especially the young, watched passionately and spread the buzz online. Singaporeans were more selective, but those who watched stayed committed until the end.

These differences show how culture shapes what we watch and how we watch it.

Want to share your own opinion?

Join Z.com Research to take fun surveys, earn rewards, and have your voice heard. Your insights help shape what content matters most.